It’s been a week since Malaysia’s Budget 2025.

As the dust settles more comfortably on the floor, I want to take a deeper look at the performance of the Malaysian market and its sectors.

Disclaimer: This is not investment or financial advice. This is meant for educational purposes and we take no responsibility for anyone’s decision.

Story of the Week: The Malaysia Market is Down after Budget 2025

This is not surprising. The FBMKLCI declined by 1.7% for the week to 1,618.

Investors didn’t take too well to the announcement of the minimum wage increases, and also the proposed expansion of Sales and Services Tax (SST).

A higher minimum wage means that companies would have to spend more on their labour and staff costs.

According to the Department of Statistics Malaysia (DOSM), one-third (2 million) of formal workers (6 million total) in Malaysia have wages that are below RM2,000.

The impact would be huge on companies’ profits.

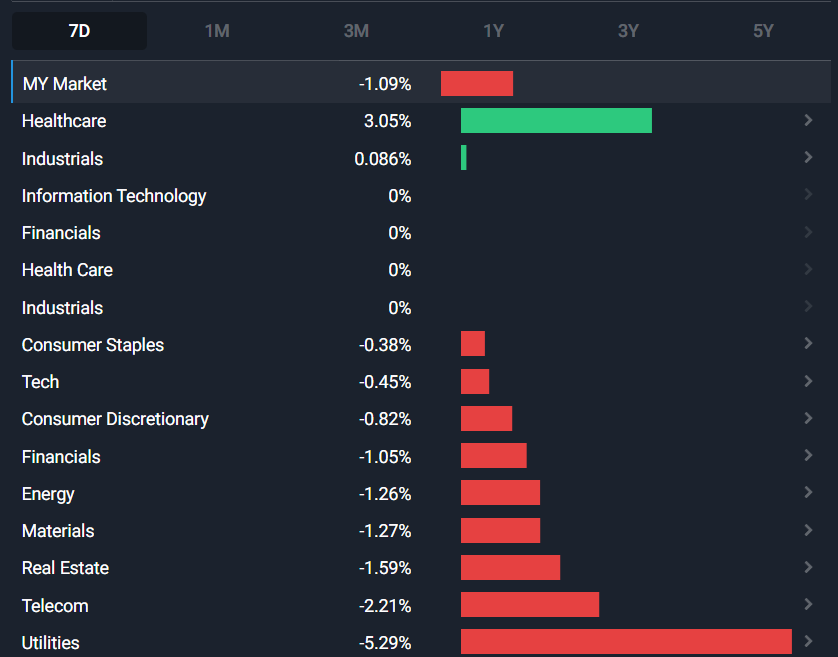

Already, the sectors of utilities, telecommunication, real estate, materials and energy were the most heavily hit last week. Source: SimplyWallSt

This is not surprising. The FBMKLCI declined by 1.7% for the week to 1,618.

Investors didn’t take too well to the announcement of the minimum wage increases, and also the proposed expansion of Sales and Services Tax (SST).

A higher minimum wage means that companies would have to spend more on their labour and staff costs.

According to the Department of Statistics Malaysia (DOSM), one-third (2 million) of formal workers (6 million total) in Malaysia have wages that are below RM2,000.

The impact would be huge on companies’ profits.

Already, the sectors of utilities, telecommunication, real estate, materials and energy were the most heavily hit last week. Source: SimplyWallSt

Markets Fresh From the Oven

The down-low to the performance of the U.S. and China markets.

The U.S.: The S&P 500 declined by 1% for the week led by the materials (-2.4%), industrial (-2.3%), healthcare (-2.2%), utilities (-1.6%), and financial sectors (-1.4%).

This was probably caused by weaker-than-expected durable goods sales data which came out at -0.8% month-on-month for Sep 2024 when the market expected -0.5%.

China: The Hang Seng China Enterprise Index (HSCEI) declined by 1.2% for the week as investors pulled back after the market rose sharply by 4.1% on 18 October 2024 following the expansion of the loan pool for property developers to CNY4 trillion and a ‘promise’ to inject CNY10 trillion into the Chinese economy.

The Big 5s in Economic and Market News

Here are the 5 big news that hit the markets last week

McDonald’s pounder problem: McDonald’s has revealed that it faces problems with E-coli and one-fifth of its outlets have stopped offering the quarter pounders.

- However, it was later clarified that it was probably the onions, and not the beef.

- If you remember, McDonald’s wanted to sue the big 4 beef producers for colluding.

Boeing in deep: Shit. It reported a quarterly loss of US$6 billion for 3Q 2024.

- Strikes continue as workers reject a 35% raise in wages.

China export control again: China has imposed export controls on items used both for commercial and military use.

- It will take effect from 1 December 2024 onwards.

Carbon guidelines for Malaysian data centres: Malaysia is finalising the carbon guidelines for data centres.

- Data centres were featured in Budget 2025 for government incentives.

Market Trends for the Week

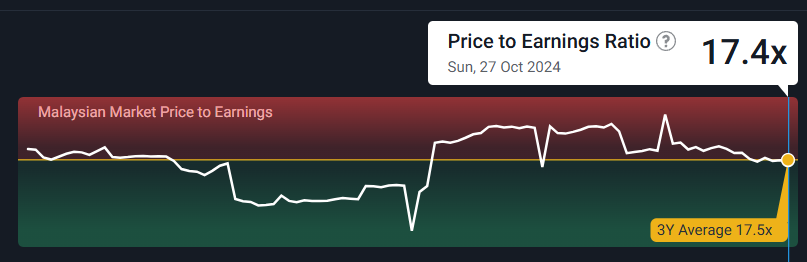

As the Budget 2025 ultimately proved disappointing to investors, valuations for the Malaysian market are right at their historical average of 17.5 price-to-earning times.

Fair valuations at historical averages normally suggest that it has the potential to

- Trade upwards: If there is a significant catalyst to drive this.

- Trade downwards: If there is a recession or markets get weak.

Most research houses are targeting the FBMKLCI to be at the 1,700 level by end-2024. Meanwhile, there is still a more than 50% chance that a recession will come for the U.S. and indirectly the world.

Take your pick.