My Thoughts for the Week

As the holiday season gets underway, investors are feeling a tad optimistic but also cashing out some of their riskier investments. The consensus is that the U.S. Federal Reserve will not let the stock market tank and will cut interest rates.

I agree also, as I have seen the Fed prioritising the economy more than inflation. So, even if inflation gets to around 3.5%, the Fed will not blink and eye and cut interest rates. But that’s provided that the current slew of economic data that is coming out shows that the U.S. economy and job market are not doing well.

Hence, as long as the U.S. economy is going down, stock markets are probably going to be up. The same is happening in China, also, with most investors there waiting for government stimulus to be announced as the Chinese economy continues to be weak.

What a weird period to be in right now. Bad economic data is boosting the stock markets, with expectations that the governments will never let them go under.

Like what you are reading? I write a weekly newsletter and articles on investment, economics and personal development. Take your financial journey to the next level with me!

Did Stock Markets Cook or Get Cooked?

The United States, S&P 500 (+0.3%): Bad news is good news. Repeat that mantra. The U.S. markets went up slightly to 6,870 despite the job payroll data showing that not all is well with the U.S. job market.

- The ADP non-farm payrolls data showed that 32,000 jobs were lost in the month of November 2025.

- The manufacturing and non-manufacturing PMI also declined.

Want to know more about why this is happening? Take a look at our Top News Analysis below.

Sectors: Technology (+1.6%), Energy (+1.5%), Consumer Discretionary (+0.9%), Telecommunications (+0.8%).

Companies: Boeing (+8.3%), Oracle (+8.3%), Warner Bros (+9.3%), Microchip (+23.1%), Estee Lauder (+11.0%), Teradyne (+11.8%), Dollar Tree (+11.4%), NXP (+14.3%).

China, HSCEI (+0.7%): The Chinese markets were slightly up to 9,198 as weak U.S. economic data has spurred rate cuts by the United States Federal Reserve (Fed).

- The official manufacturing PMI of 49.2 for November 2025 (a slight increase from 49.0 in October) still shows that the Chinese economy is contracting. However, the non-manufacturing PMI dipped sharply to 49.5 in November 2025 from 50.1 in October 2025.

- Investors are now waiting for some policy support from the Chinese government at the latest Beijing economic work conference.

Sectors: Materials (+2.1%), Energy (+2.0%), Industrials (+1.4%), Financials (+1.1%), Utilities (+0.8%)

Companies: Zijin Mining (+12.1%), CNOOC (+4.3%), Ping An (+6.6%), Sunny Optical (+8.0%), Baidu (+6.9%)

Malaysia, FBMKLCI (+0.7%): The Malaysian market is up by 0.7% to 1,617 as some bargain-hunting activities have emerged for some large-cap stocks that are trading at cheap valuations.

- The conclusion of the Sabah election did not create much political volatility with the ruling party, Gabungan Rakyat Sabah (GRS), retaining its majority.

- Finance and banking stocks were on a tear last week, with large banks gaining on bargain hunting from investors.

Sectors: Financials (+2.2%), Materials (+1.7%), Healthcare (+1.4%), Telecommunications (+0.9%)

Companies: RHB (+5.2%), CIMB (+3.4%), IOI (+3.0%), Maybank (+2.7%), Telekom (+5.0%), PetChem (+8.0%), Axiata (+4.8%), Nestle (+4.8%).

Top News of the Week

In-depth analysis of the top news of the week, without the fluff and bluff.

The Federal Reserve Conundrum (U.S.)

Once again, the probability of the Federal Reserve (Fed) cutting interest rates in December 2025 has increased to 90% this week from 41% previously.

You know what’s interesting? It has been about 2 years since good news for the market is bad news.

Let me explain.

When the Fed raised interest rates to fight inflation from 2022 to 2023, everyone thought the world was going into another recession. What ended up happening was even stranger. The U.S. economy chugged along at a strong rate. The job market was doing quite well.

Most importantly, the AI market boom was in full effect. Nvidia went from a fringe computer GPU company to the forefront. Valuations rose to dizzying levels, and we witnessed one of the craziest market gains in recent years.

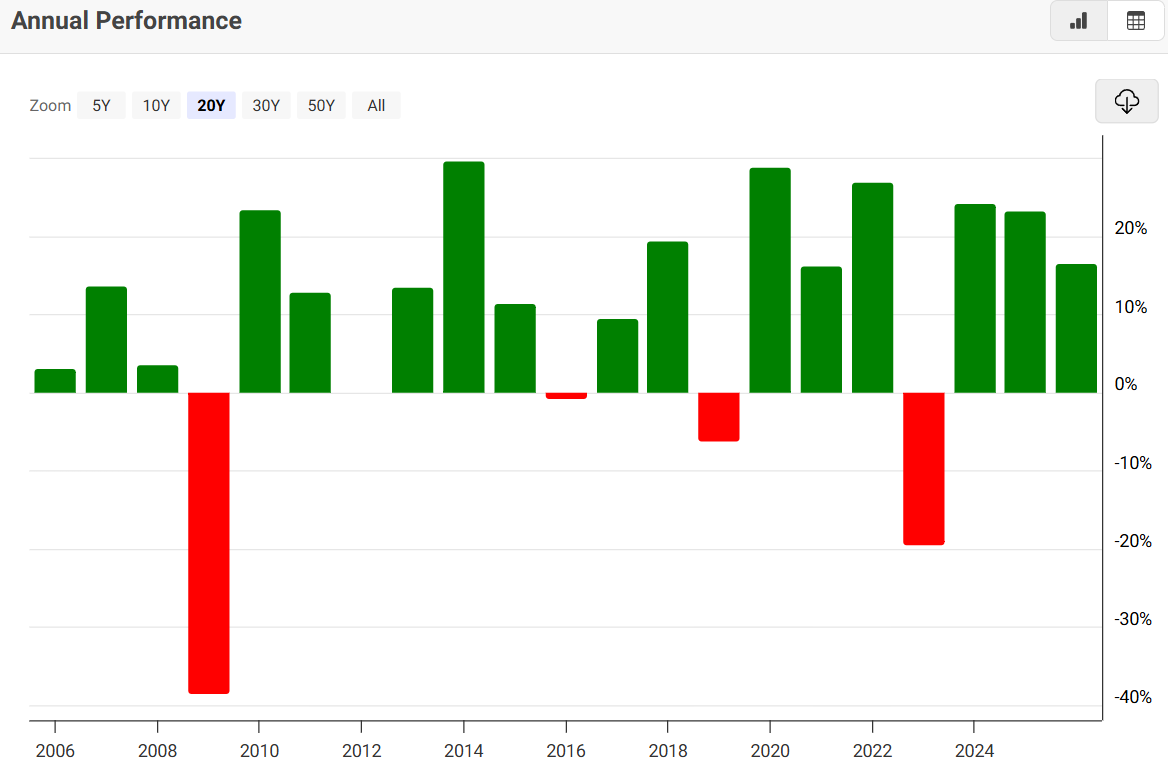

- The S&P 500 rose by 24% in 2023 and 23% in 2024.

When inflation cooled down by the end of 2024, the Fed started to reduce interest rates again. Inflation was near the 2.0% level, at around 2.3% to 2.7%, and there were already signs that the U.S. economy was not doing that well.

- Firstly, Trump’s presidency was already showing signs that it could plunge the U.S. economy into a recession. He already talked about tariffs on the whole world, to ‘Make America Great Again’ by bringing back U.S. industries.

- Secondly, many tech companies were already laying off workers en-masse in the name of Artificial Intelligence and ‘reducing costs’.

Investors were already expecting some kind of mini-recession when Trump further escalated his tariff policies in March 2025. Hence, they looked to the Fed for ‘support’ for the markets as they thought that it would prioritise the economy (and indirectly the stock market).

This is not new.

In the early 2000, investors all knew of the ‘Greenspan put’, where Alan Greenspan, then Fed chairman, always reduced interest rates to support the stock market after the Dotcom bust.

Now, as bad economic data comes out, investors actually cheer it as they think that the Fed will continue to cut interest rates to support the stock market. And it’s going to get worse with interference from Trump.

Trump has explicitly wanted control over U.S. interest rates (a big no-no to central bank independence) as he has repeatedly asked the Fed to cut interest rates to deal with the economic fallout of his tariff policies.

With the appointment of the Fed chairman due by April 2025, most of the Fed officials who want that position will probably need to align themselves with Trump.

Intel 3Q Results (U.S.)

Intel’s 3Q 2025 results exceeded expectations as they received government investments/funding and also made some crucial deals.

It has been about 5 months since the U.S. (aka Trump) took a 10% stake in Intel for US$8.9 billion. Talking about Intel inevitably involves the other key AI players in the market – Nvidia, Microsoft, and Softbank.

Intel, once an electrical and electronic chip behemoth, fell from grace 3 years ago. Revenue declined by 20% and 14% in 2022 and 2023, respectively, before it declared a huge loss of US$18.8 billion.

- This coincided with the emergence of Nvidia as an AI powerhouse, where many investors sold Intel as it was fast enough to capture the AI market.

- Cheaper alternatives, such as TSMC and Foxconn, also threatened the competitive advantage of Intel.

Its 3Q 2025 results are an important development for Intel’s turnaround. For one, it marks the start of the U.S. government involvement in the company, its collaboration with Nvidia, and also its plans for the AI industry.

- Revenue rose by 2.8% to US$13.7 billion in 3Q 2025.

- Intel reversed direction with a profit of US$4.1 billion (3Q 2024: -US$16.6 billion)

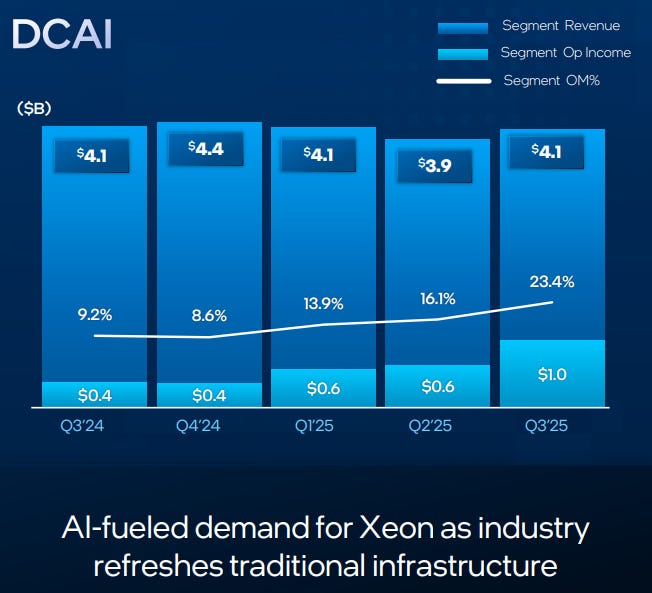

Crucially, the operating profit margin for its Data Centre and AI segment has almost doubled from 9.2% last year to 23.4% currently. The bad thing is that revenue for this segment is also down by 1%.

What does this mean to investors in Intel? 3Q 2025 results represent the potential start of the turnaround of the company. After its controversial but ultimately necessary cut in its workforce, it would have to show that it needs to pivot to the AI industry and generate increased revenue in the coming year.

Alibaba 3Q 2025 Results (China)

Alibaba has been a compelling and important case study of the AI bubble forming in the Middle Kingdom.

3Q 2025 results are out, and one of the most important developments (according to investors) is this – how did its cloud intelligence or AI segment did?

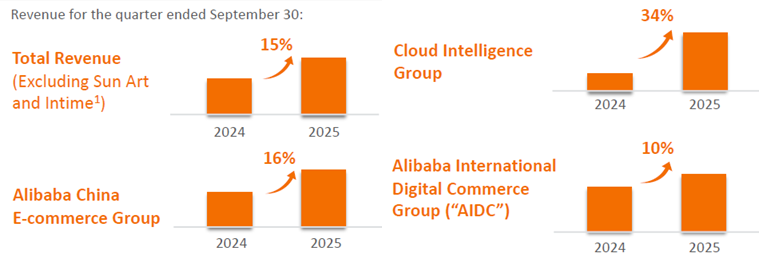

Rest assured, it did quite well. Revenue for its Cloud Intelligence segment grew by 34% in 3Q, with AI-related product revenues growing by triple digits. And it was the fastest-growing segment in Alibaba.

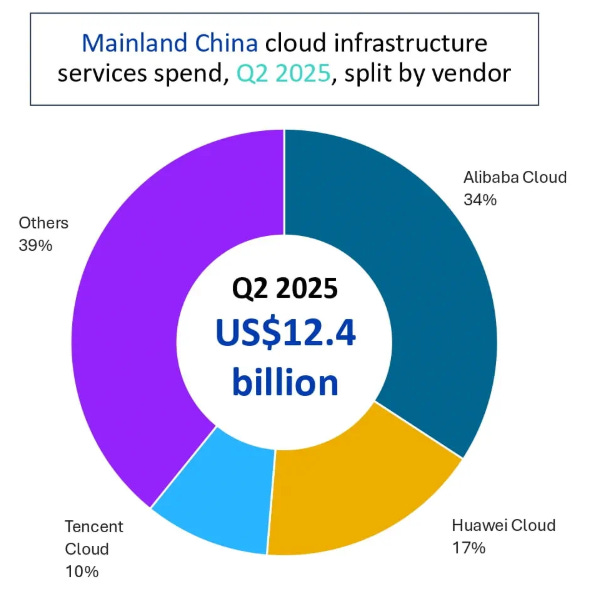

In the Chinese AI market now, Alibaba is the leader with a 34% market share. And the general AI industry has grown by 20% for 2Q 2025.

Alibaba is betting big on AI as it sees that its core e-commerce business will benefit from AI investments. But will it suffer from investors’ fickle fingers on the trigger of the buy and sell buttons? We already have such a case happening in the U.S. AI market, when investors sold many AI stocks on fears of an AI bubble.

China Economic Indicators are Flashing Red Again

Latest Purchasing Manager Index (PMI) readings are showing red again.

I think China is heading down the same path as the U.S. stock market and economy. If you have read this before, bad economic news is good news for the stock market in the United States. Most investors are now betting that the U.S. central bank and, indirectly, Trump, will not let the economy go into a recession again.

Hence, they are treating bad economic data as a push for the Federal Reserve to cut interest rates and support the stock market. I suspect the same is happening in China, also.

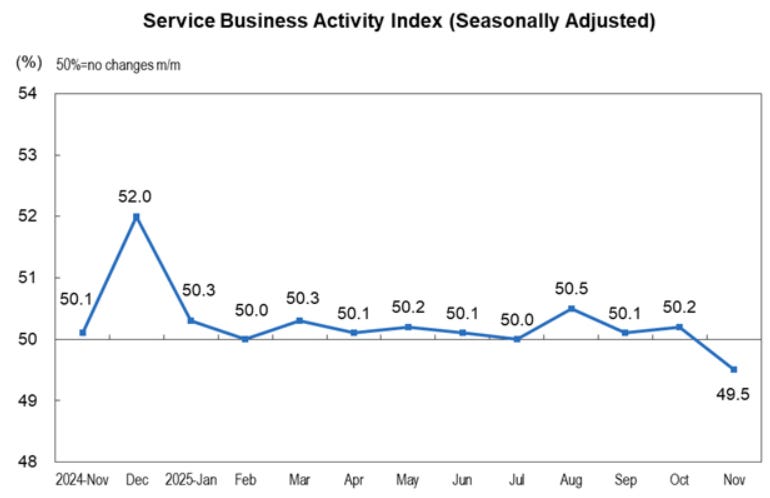

- The recent NBS non-manufacturing PMI has dipped below 50 (anything above 50 indicates businesses want to expand, and below 50 indicates businesses want to pull back), to 49.5 points in November 2025 – the first time it in a very long time.

- The sub-index of business activity dipped to 49.5 from 50.1 previously. Meanwhile, the new order index also declined to 45.7 from 46.0 previously.

The sub-index declines indicate that China’s services and consumption are not holding up well at all and have started to decline. The central government has in recent years, been trying to get Chinese consumers to spend more in the economy, rather than save. But it has not been working.

- A deep property downturn for the past five years means that most Chinese households have experienced a loss in housing wealth. Almost 70% of Chinese household wealth is in housing.

- Meanwhile, the job market for young Chinese is crashing hard. October 2025 recorded 17.3% for the youth unemployment rate – one of the highest levels.

However, the stock market has not been reacting to this news in the right way. It has instead been on an upward trend. Behind this is the expectation that the Chinese central government will do whatever it can to support the Chinese economy and stock market. And hence, investors are now just waiting for any policy stimulus announcement.

Sounds like the United States.

Investment Themes of the Week

Some trends that I spotted while I was reading through the world news.

Malaysia Banking Sector – Defensive Play?

Bargain-hunting activities are now in full swing in the Malaysian banking sector. Last week, they rose by 2.2% and were the best-performing sector. Here are their price-to-earnings ratio (PER).

- Maybank: 11.7x

- CIMB: 10.9x

- Public Bank: 11.8x

- Hong Leong: 10.3x

- RHB: 9.6x

- Alliance: 9.4x

- Bank Islam: 9.4x

As the stock market goes to the year-end, investors are cashing out of risky stocks and going into safe stocks such as banking to welcome 2026.

If you have read all the way to the end, you are a champ. Thank you so much for reading my content and if you like it, give the channel a subscribe.

Appreciate all the support.