Interest rates will likely be cut in 2026, especially with the appointment of the new Fed chairman. Trump has made it very clear he will appoint someone who will align with his economic policies, and that means the Fed is probably going to be quite trigger-happy in terms of reducing interest rates.

In my view, two sectors traditionally will benefit from lower interest rates – real estate and banking. They go hand-in-hand with each other. Lower interest rates mean lower borrowing costs for people to buy houses and companies to invest in.

- The real estate sector might see higher demand from homebuyers to buy houses.

- The banking sector might see higher loan demand.

For this week, I will be reviewing the real estate sector in the United States from a broad economic viewpoint for Part 1.

My main point is that the U.S. real estate sector is currently weak as the job market and U.S. economy are weakening, while U.S. builders are building more houses. These factors have come together to depress property prices.

There are a couple of indices that I normally look at, but the framework I use is grounded in the demand and supply for real estate.

- Higher demand, higher property prices and vice versa

- Higher supply, lower property prices and vice versa

Disclaimer: This is not investment or financial advice. I take no responsibility for anyone’s decision regarding this.

Want to cut out all the noise? I do solid research work into economics and investments, and deliver you nuanced insights. No frills, no thrills. Just boring old research for boring old investments. Because boring is good. Subscribe to my channel if you want more of this!

Property prices in the United States softened in 3Q 2025

To me, property prices are the first thing I look at. It shows me what I need to know about the market trend. It is an indicator of how much demand and supply are in the market now.

Higher prices typically mean higher demand for real estate, and vice versa. Meanwhile, a higher supply in the market means that prices will probably also drop.

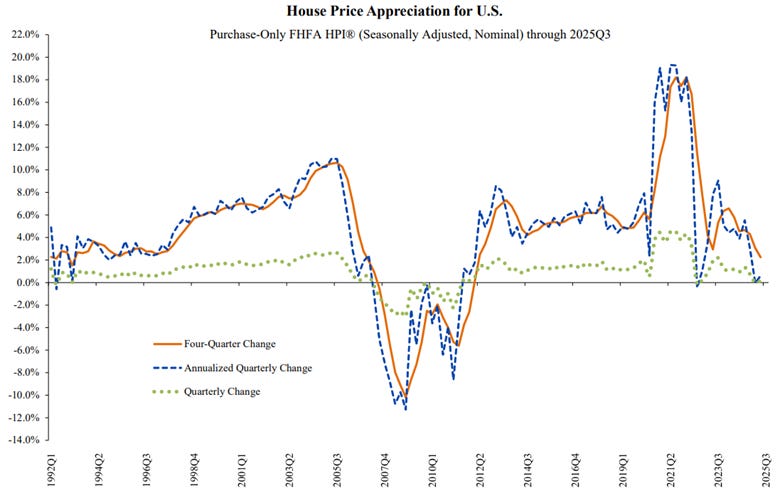

This is the house price changes from the Federal Housing Finance Agency (FHFA), which indicates that house price growth has softened to 2.2% in 3Q 2025 from 3.1% in 2Q 2025. House price growth has been on a steady decline since reaching a peak of 18.2% in 1Q 2022.

Two possibilities arise from this.

- Demand could have dropped from U.S. homebuyers.This is a strong possibility now, considering that the U.S. job market has steadily weakened throughout the year as companies announce massive layoffs, and Trump has cut the government workforce, too.

- Supply has outpaced demandAs house prices were quite strong in 2021 and 2022, U.S. builders could have built more to take advantage of the higher selling prices.

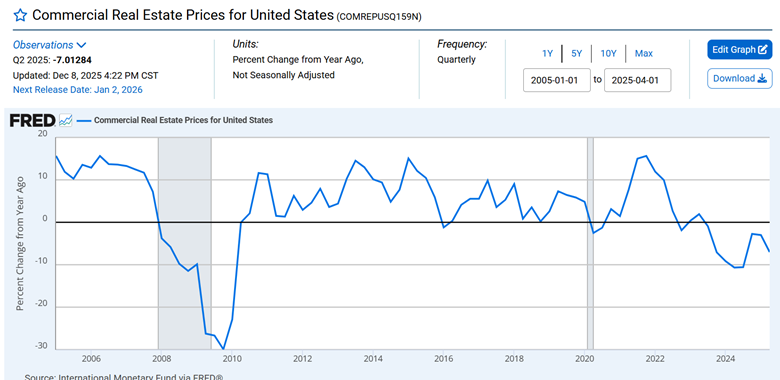

But residential properties are not the only ones in the U.S. It also has commercial properties. Based on FRED, commercial property prices declined by 7% in 2Q 2025, and have been declining since 3Q 2023 (-0.9%).

Overall, combining both the residential and commercial markets, it can be concluded that the property market is softening in terms of pricing.

This is consistent with a softening job market and economy

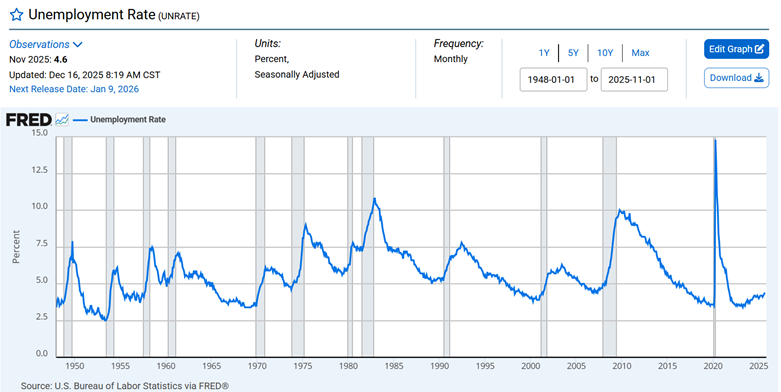

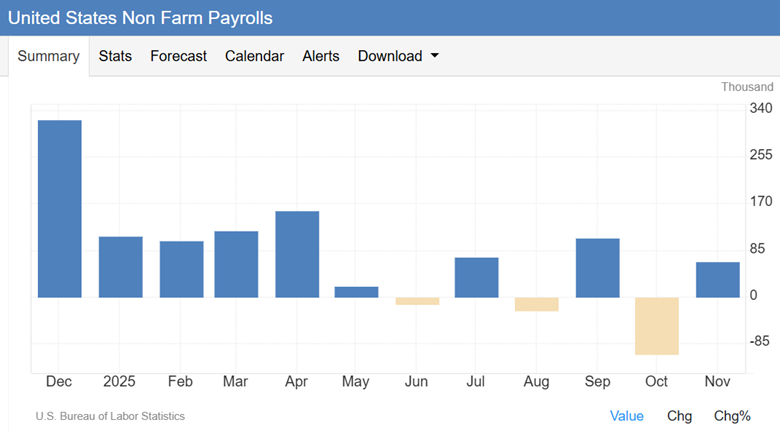

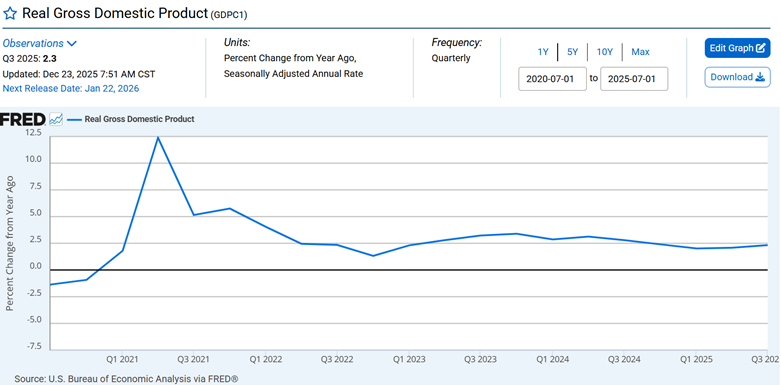

I look at three indicators mainly to assess the demand for housing – unemployment rate, job payrolls and the gross domestic product growth.

My rationale is that if people are losing jobs and finding it hard to secure new work, this will lead to lower income and lower demand for housing. This is reflected in the unemployment rate and job payrolls.

If the gross domestic product growth is also weak, it means companies are finding it hard to generate profits and revenue, and thus will not hire as much.

The unemployment rate has increased to 4.6% in November from 4.4% in September 2025. Concerning, but not disastrous, as it has been higher before this.

Meanwhile, from the job payrolls’ point of view, the job market has been losing more jobs in recent months as the government shutdown has impacted federal employees. To note, October saw a loss of 105,000 jobs.

Lastly, gross domestic product growth was at 2.3% in 3Q 2025 – not bad, but not great either. This is quite in line with the historical average of 2.0%.

Looking at all these indicators together, the demand for housing is indeed softening. But the big question is – is it weak enough to cause a drop in property prices?

My answer to that is – just a little bit, but it doesn’t explain all the weakness in property prices.

Let’s turn over now to the supply situation.

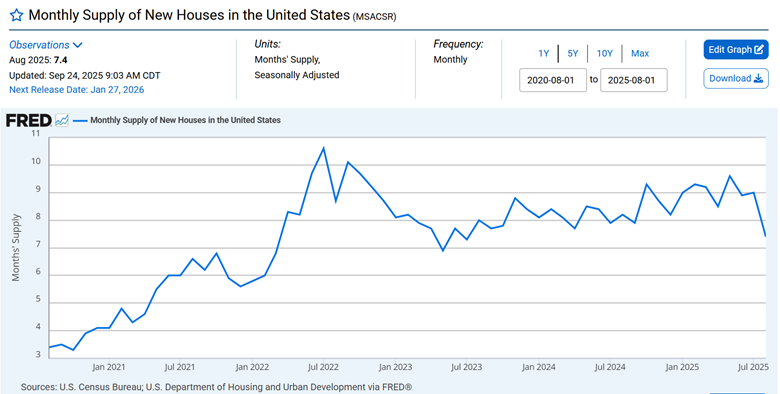

Companies are building and supplying more houses

The supply of housing in the United States has been really strong in the past three years. While the growth dropped to 7.4% in August 2025 from 9.0% in July 2025, it has averaged around 8.3% every quarter since January 2022.

This, to me, illuminates the property market puzzle. The economy is doing ok, but not great, while people are losing jobs. With a lower income, they don’t want to buy houses. Meanwhile, the builders are building even more, further depressing property prices.

Further interest rate cuts could boost the U.S. real estate sector

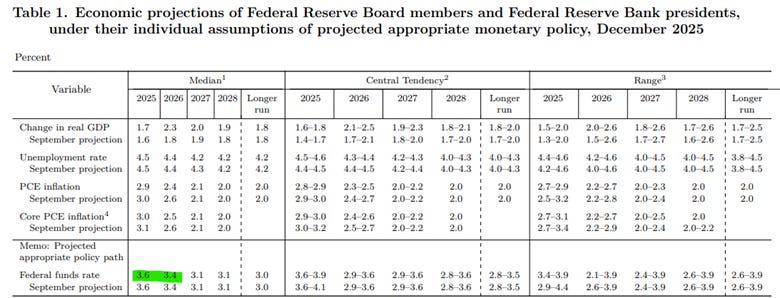

It is quite established already that the Fed will probably cut interest rates next year. The Fed median interest rate projections for 2026 (3.4%) indicate that one or two rate cuts could be in the book from the current 3.6%.

Conclusion

I have established that the U.S. property market as of December 2025 shows signs of weakness with a not-so-good economic outlook. The job market is weakening, and companies are hesitant in hiring, while the economy is just doing ok. Meanwhile, builders have continued to build more houses and properties, further dampening property prices.

However, with the Fed projected to reduce interest rates further in 2026, I do see some opportunities for the U.S. real estate sector.

But the question is which part of the real estate sector – residential, commercial, industrial, or data centre – would stand to benefit more in 2026.

That will be my focus in part 2.

And then, finally, in part 3, I will go deeper into the specific companies’ pros and cons and whether they will fare well in 2026 in light of these developments.