My Thoughts for the Week

Welcome to 2026, where nothing much has changed, but we still have to talk about Trump. Fresh on people’s minds, will there still be tariffs? The U.S. Supreme Court has yet to decide on that, but expect a decision by end of January 2026. The U.S. job market is showing signs of weakness, but it hasn’t completely gone bonkers. Meanwhile, investors are honing in on two key issues for the year.

Firstly, will the Federal Reserve be independent with the departure of Powell in May 2026? We have all accepted that it will probably be quite trigger-happy in reducing interest rates, but the key question is how investors will react to a Fed that possibly could tow President Trump’s economic line.

Secondly, will the AI sector keep booming as it has in the past couple of years? Towards the end of 2025, some have begun to question whether these AI investments have already generated any returns. The answer is … generally no. LLM models, of course, have shown improvements, but investors have not seen how they lead directly to better company operations and profits. Meanwhile, these companies are asking for more and more money, like a drug addict asking for one more hit.

In China, it’s always about the economy, and possibly Taiwan and Japan. Chinese consumers are not spending. Chinese EV players could face a make-or-break situation in 2026, and the sector could see some major consolidation. On the geopolitical front, China is already showing that it could possibly go to war, but that remains unlikely. Japan in the meantime, could see trade declining to China as its new president struggles to deal with the fallout of its ‘we need to defend Taiwan if it comes to it’.

Malaysia, well. I don’t think there’s much here. To me, no bad news is considered good news. The KLCI is approaching the 1,700 level, and the Ringgit has recently gone on a tear. But there really hasn’t been any real catalyst for the local market. The government has been constantly talking about AI investments, but most of those are in data centres, which are property plays, and to be honest, don’t really benefit the local economy and job market.

Like what you are reading? I write a weekly newsletter and articles on investment, economics and personal development. Take your financial journey to the next level with me!

Did Stock Markets Cook or Get Cooked?

The United States, S&P 500 (-1.0%): The S&P 500 is down by 1.0% to 6,858 as investors took profit before the end of the year, especially in the AI sector, and digested the Fed minutes, which show a divided board.

- The Magnificent 7 Index declined by 2.3% last week, as investors took profits off AI companies, growing increasingly nervous about valuations.

- Meanwhile, the Fed minutes for December’s FOMC meeting showed two conflicting sides – one side aggressively wanting to cut interest rates, while the other wanted to maintain in case inflation increases again.

Sectors: Consumer Discretionary (-2.7%), Technology (-1.5%), Financials (-1.3%), Materials (-1.0%)

Companies: Palantir (-11.1%), Shopify (-8.0%), Tesla (-7.8%), Intuit (-7.0%), Progressive (-6.6%), DoorDash (-6.1%)

China, HSCEI (+2.8%): China’s market started the year with a bang, rising by 2.8% from 8,915 to 9,169, as investors expect more policy support from the government and hype around its AI stocks.

- While economic growth averaged around 5.3% for the first three quarters of 2025, investors are expecting some policy support from the government to boost consumption.

- Chinese GPU company, Biren rose sharply by 75.8% on its first day of trading, continuing the hype around Chinese AI-related companies.

Sectors: Energy (+3.9%), Technology (+3.8%), Materials (+3.6%), Telecommunications (+2.5%), Financials (+2.2%)

Companies: Baidu (+20.3%), Geely (+7.6%), NetEase (+7.3%), SMIC (+5.7%), Xpeng (+5.6%), BYD (+5.5%)

Malaysia, FBMKLCI (-0.4%): The Malaysian market was slightly down as foreign investors sold their positions towards the end of the year. This was, in turn, offset by local investors buying into the market.

Sectors: Materials (-1.6%), Technology (-0.9%), Consumer Staples (-0.5%), Telecommunication (-0.5%)

Companies: Petronas Chemicals (-4.4%), PPB (-3.3%), Hartalega (-2.0%), Press Metal (-1.8%), Telekom Malaysia (-1.7%), Genting (-1.3%)

Top News of the Week

In-depth analysis of the top news of the week, without the fluff and bluff.

Fed Meeting Minutes (United States)

The latest December 2025 Fed Meeting minutes show a divided Federal Reserve, which could be good and bad, depending on how you see it.

Is it the case that the Fed will definitely cut interest rates in 2026? That’s what I am interested in when I read the minutes. We kind of know what the Fed will be, because Trump will appoint someone who will cut interest rates. He has not announced it yet, but everyone’s money is on Kevin Hassett, a White House advisor (and most importantly, who agrees with Trump), to be the Fed chair.

Currently, the Fed projects that there will be two interest rate cuts in 2026. But it probably won’t happen in the ‘near-term’. What this means depends, as the Fed’s minutes wordings are these:

With respect to the extent and timing of additional adjustments to the target range for the federal funds rate, some participants suggested that, under their economic outlooks, it would likely be appropriate to keep the target range unchanged for some time after a lowering of the range at this meeting.

‘Some time’ could mean 3 months or 6 months, but the Fed will probably not cut interest rates in its January or February 2026 meetings. This is provided that the labour market doesn’t deteriorate further and inflation doesn’t increase. On this end, the Fed clearly has two points regarding this.

- The job market has worsened in the past couple of months, with the unemployment rate increasing and jobs decreasing.

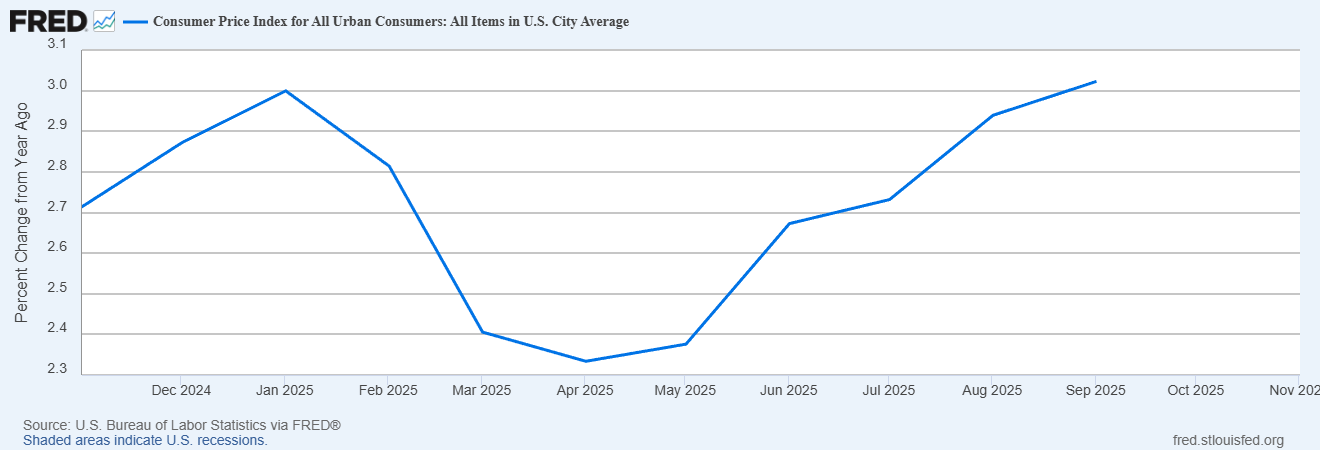

- Inflation remains above the 2.0% target, and they are still trying to bring it down to the target. However, inflation pressures from tariffs have decreased.

Generally, the Fed agrees that this rate cut in December is a preemptive move to keep the job market chugging along in case it crashes. But herein lies the disagreement about inflation. Most have agreed to cut, but two officials, Austan D. Goolsbee and Jeffrey R. Schmid, have opted to keep interest rates unchanged. 2025 was technically a very slow year in terms of reducing inflation to the 2% target. And with inflation trending upwards again, the Fed has a duty to commit to bring it down further to the target.

Investors are getting a bit discomforted by two things here. Firstly, will the next Fed chairman be independent enough (away from Trump) to conduct effective monetary policy? Kevin Hassett (who shows all the signs of being a Trump loyalist) has publicly said that Trump’s words will have no bearing on his chairmanship. But who knows? The proof is in the pudding. Investors, for now, will give him the benefit of the doubt.

Secondly, will the Fed be more divided next year on interest rates? Disagreements could lead to mixed signals to the markets, and in turn, make investing harder and more unpredictable.

All of these will probably hinge on the strength of the job market and how inflation copes with the tariffs this year.

Biren’s IPO Shows Hype is Still On for Chinese AI (China)

Biren’s share price rose by 75% on its first listing day, showing that investors are still bullish on Chinese AI companies.

I see a pattern now. With the Chinese government very gung-ho on promoting its own local Chinese AI companies, many of them are now listing on the market. It is quite obvious, they see investors being hype on the trend, and hence, valuations will be high for their company.

Biren is a chip designer and producer specialising in graphic processing units (GPUs) that are used to power AI models. Crucially, it was founded in 2019 in China. Something that the Chinese government likes.

Hype is hype. But many of the recent Chinese AI listings show that these companies are not that profitable. As of 30 June 2025, Biren has incurred a total loss of RMB 8.1 billion. At this point, there definitely is a bubble in the Chinese AI sector.

But how big? It’s hard to definitively say how big a bubble is, even for established markets such as the S&P 500. What more for the Chinese market that is notoriously opaque and full of fraud and inaccuracies?

However, here is an attempt. According to SimplyWallSt, the tech sector is trading at a very high price-to-earnings ratio of 121 times. If we delve down deeper into the subsectors, it’s quite scary.

The semiconductor sub-sector is trading at a -1227.6 times, while software is at -280 times. A negative PER means that the companies are making losses, but the share price is trading at very high prices. Not going to lie, such high share prices for loss-making companies are making me jittery about the scale of the bubble.

Is Biren something like that, too? Only time will tell.

Make or Break for Chinese EV players? (China)

2026 could be a make-or-break year for many Chinese electric vehicle (EV) players, as the price war continues.

It’s 2026, and we are still in a price war in China’s EV industry. Can you imagine? What started in 2022 from Tesla’s price cut is still going on? According to SCMP, about 50 EV players are still unprofitable. They have three choices here: 1) gain a competitive edge and become profitable, 2) merge (or get acquired) with another EV player, or 3) close shop.

Two factors are making EV players worried. Firstly, there is a lack of demand from Chinese consumers and an oversupply of EVs. Chinese retail sales growth softened to 1.3% in November 2025 from 2.9% in October 2025. What’s more concerning is that automobile sales have declined by 8.8% in November 2025, a deeper contraction compared to -6.6% in October 2025.

Typically, the end of the year means that many Chinese are more willing to buy cars. But that is not the case this year. The spending situation in China is getting worse, with basic necessities spending declining by 0.8%. Meanwhile, Chinese EV makers are continuing to ramp up production of EVs as they have ‘no choice’ but to lower prices and compete with each other.

Secondly, the Chinese government is taking away some of the EV incentives and subsidies. Most importantly, it is raising the threshold for Chinese consumers to trade in their vehicles to buy EVs or hybrids. They are eligible to get a rebate to do that, but their car values now have to be much higher. This is the biggest factor now that is driving Chinese consumers away from buying EVs.

2026 is turning out as the finale of the survival of the fittest in China’s hypercompetitive EV industry.

Investment Themes of the Week

Some trends that I spotted while I was reading through the world news.

Chinese EV Sector ‘Winners’

With the EV sector in China possibly coming to an inflexion point, it’s time to take a better look at the ‘winners’ from the sector. At this point, EV companies that are already profitable and have some market share are probably going to survive. To note

- BYD: Market leader both in China and global market.

- Leapmotor

- Li Auto

- Xpeng

- Nio

If you have read all the way to the end, you are a champ. Thank you so much for reading my content and if you like it, give the channel a subscribe.

Appreciate all the support.