Could 2026 be the year for property?

In the first part here, we examined the macroeconomics fundamental of the U.S. property sector and found that:

- U.S. property market shows some signs of weakness, and the economic outlook is not looking too fantastic with the job market weakening.

- U.S. builders have continued to build more, further depressing property prices.

In this article, we will take a deeper look at the U.S. property sector in 2025 and analyse which sub-sectors did well and are expected to do well in 2026. This will help us determine the main characteristics that we are looking for when we want to invest in U.S. real estate stocks.

Multifamily (Residential): Pockets of Opportunities in an Otherwise Weak Market

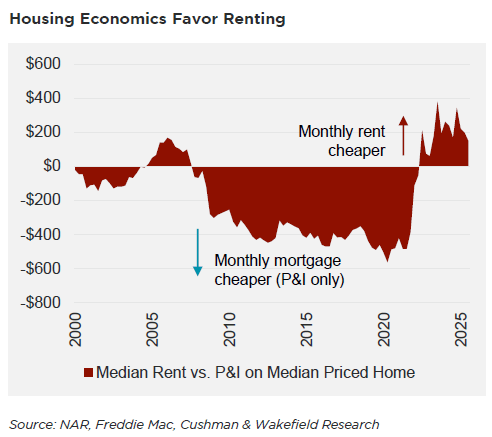

Will Americans ever be able to afford homes? Those were my thoughts as I was reading up about the residential sub-sector. It is quite surreal to read that many are forced to rent even when the economy has been doing relatively well. According to Cushman and Wakefield, the housing economics now favour renting. Owning a house is significantly more expensive than renting.

Thinking about it more now, it is not surprising. The Federal Reserve has raised interest rates since 2022 to bring inflation down. And that has increased most Americans’ loan repayment for a house. As a result, property prices have been depressed in the past couple of years, with U.S. builders continuing to build more houses. Rent also has softened as apartment owners have decided to keep rents for new leases low to attract tenants (Cushman & Wakefield, 2025).

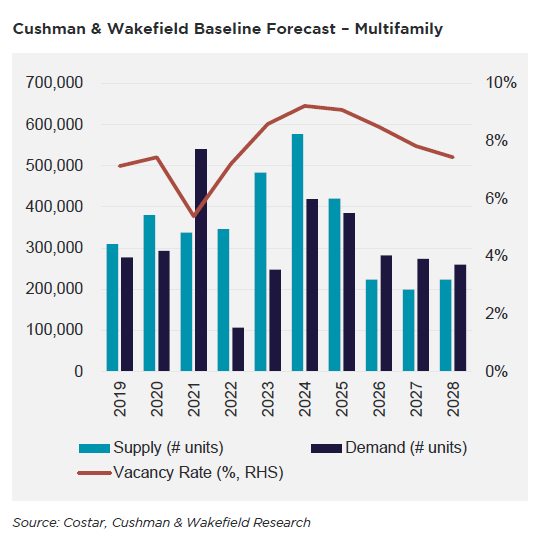

However, that has changed slightly. Residential starts (new construction) are projected to fall to two-thirds from their peak, the lowest level since 2012 (Cushman & Wakefield, 2025).

In the next few years (2026 – 2028), demand is projected to outpace supply. This means rents could be on the rise again, and also house prices.

However, I don’t think this tells the full story. Most projections about the U.S. housing supply take into account current information in the market. Things can change. And very quickly, too. A sudden rise in job market prospects and economic outlook could push many developers who are on the edge to invest and build again.

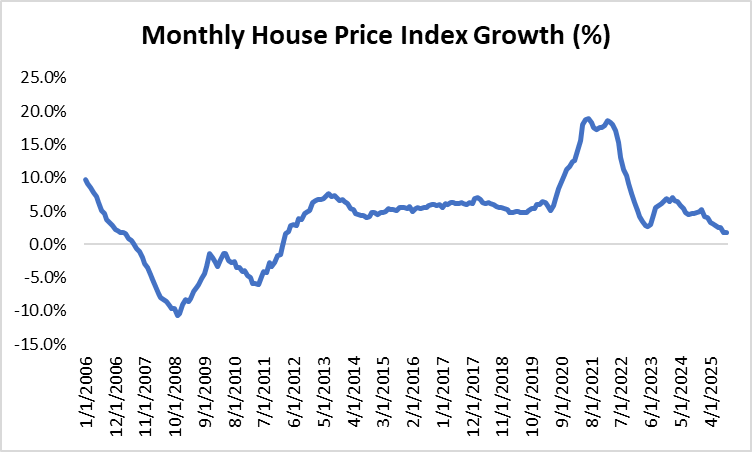

At least, according to data, house prices growth has been coming down since the beginning of the year, and is now at the weakest levels since 2012 (Oct 2025: 1.7%). While there have been some positives for 2025 and 2026, the outlook still looks pretty weak.

However, pockets of opportunities still exist in the residential market. According to U.S. Federal Housing 3Q 2025 data, here are the top 5 states with the highest house price increases.

- Illinois: 6.9%

- New York: 6.8%

- North Dakota: 6.3%

- New Jersey: 5.9%

- Connecticut: 5.9%

Office: Recovery?

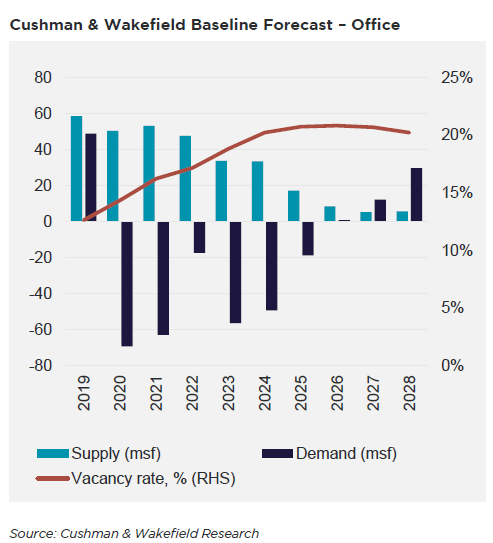

Since the pandemic, the office sub-sector has been in a rut. Remote and hybrid working essentially meant that demand for office working space is declining. Vacancy rates in the office space shot up to about 20% in 2025 from 13% in 2020. All the while, U.S. construction companies and developers, stuck with a still-constructing pipeline, continued to supply to the market. Office rents for sure are weak now.

However, the construction of offices has started to scale back now in response to the weak demand. This was the sign of recovery that the office market is seeing. Lower office supply means that the current office stock can possibly raise rents. This will hinge on the demand side too.

More companies are moving to back-to-office arrangements, and demand for offices is slowly picking back up. This is especially true in major cities. According to Cushman & Wakefield, the markets in New York, San Francisco, Los Angeles, Nashville, Atlanta, Tampa, Dallas and Austin have seen more companies looking to rent office spaces.

Lower supply, coupled with a higher demand, means that office rents could be on the way up.

That is half the story. The U.S. job market is currently still weak, and major technology companies are already citing layoffs connected to jobs that could be replaced by AI. But there is a silver lining here. Most economists now expect economic growth to be higher in 2026 and the job market to make some recovery, with Trump tariffs expected to have a mild impact.

The office space could be at the cusp of a gradual recovery, with demand from companies picking up and office supply dwindling, supporting a rent recovery. Of course, there are already established opportunities in the market with many Grade A office spaces reporting high occupancy rates in the cities mentioned above.

Industrial: Sentiments recover with lower Trump tariff impact, while data centre shines

It’s a tale of two cities.

One, the industrial side is highly dependent on Trump tariffs. The second, data centres riding the AI boom. At the beginning of the year, we all thought that the industrial sector would be doomed. Trump was ramping up his tariff tactics that affected every industrial company. Companies were worried that they couldn’t import raw materials from overseas that are needed to produce the final goods in the U.S.

By the end of 2025, those fears had dissipated. Currently, Trump’s tariffs are at the Supreme Court for a ruling on whether they are legal or illegal. The U.S. Lower Courts have declared them illegal. And the market has called Trump’s bluff by coining it TACO (Trump always chickens out). Yes, there were tariffs but not as severe as expected.

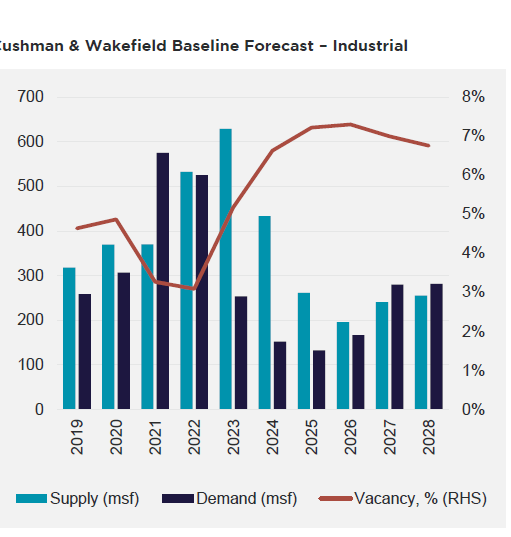

The industrial sub-sector was a good surprise by the end of 2025, demand for industrial properties rose as most companies were now clear that the tariffs would have a milder impact (Cushman & Wakefield). The research house has increased the demand projections for the industrial sector as a whole.

Meanwhile, from the supply side, the construction of industrial properties is also trending down, which will provide support for industrial rents. Furthermore, industrial production growth has gradually recovered in 2025, registering positive growth compared to declines in 2023 and 2024 respectively.

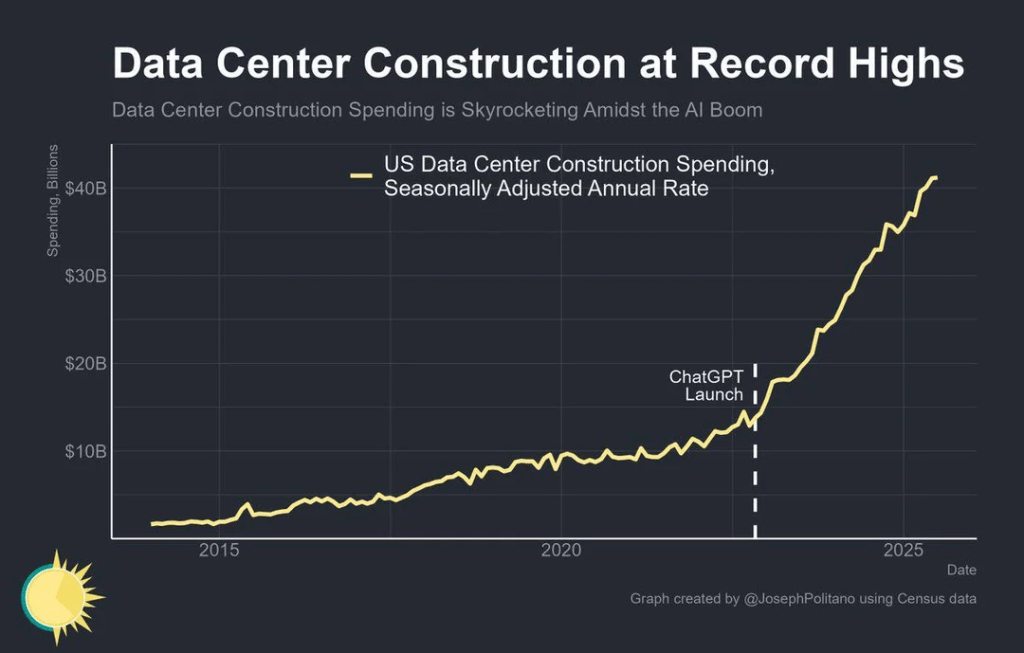

The data centres sub-sector, on the other hand, is in a crazy boom. The AI sector requires a lot of computational power to scrape the internet for data and information. Hence, in the past couple of years, data centre construction has ramped up to supply that demand from the big tech companies.

Retail: A K-shaped consumer spending

Are we back to feudalism?

The U.S. economy is doing fine, but it’s because of huge AI investments and … spending by the high-income groups. The middle- and low-income groups’ spending has declined as they cite high costs and are switching to cheaper alternatives. But the high-income groups are spending even more than before.

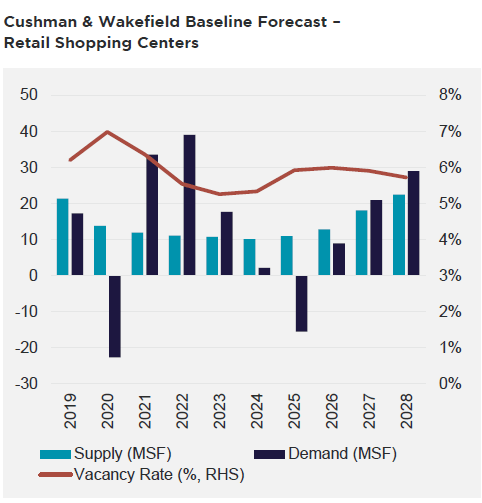

Retail spaces will inevitably be tied to the pace of consumer spending. Aside from that, e-commerce will also reduce demand for them as consumers switch to online spending even more.

Cushmand & Wakefield projects that demand for retail will improve in 2026 and onwards, driven by higher jobs and income. I, however, don’t share that view. I do think retail will have to pivot quite hard to match the e-commerce side in terms of experience. We shop because we want to feel good when shopping. The current retail environment needs to improve significantly in its experience offerings to encourage people to drive themselves all the way to the shop, park, walk around, and buy things. At the moment, e-commerce allows you to just watch Netflix at your couch and order something online – a much easier experience.

Retail players that can successfully provide that kind of experience will succeed in the market, and they will need to have a prime retail location to attract shoppers coming back consistently.

Conclusion

Based on what I have learned, there are a few key points that I can use for part 3 in identifying potential investment opportunities.

- Data centre REITs and construction companies will probably be the best-performing sub-sector, driven by higher AI investments.

- Industrial REITs look like they are recovering from Trump tariffs.

- The housing market seems to be weakening but there are some opportunities in major cities.

- The retail space will be highly dependent on the strength of consumer spending, which in the current environment, shows a weak job market.

In part 3, I will go into detail on how I will be using these insights to filter for REITs and real estate players.