Last week, I had one of my best days yet. I went out for breakfast with my wife and baby daughter, had some kolok mee and Teh C. Then, we went to pick up my wife’s yarn shipment. Man, 60 kg of yarn is no joke.

I nearly broke my back, carrying them. Selling yarn in Miri, Sarawak, is not easy. She has to import the yarn, pay 20% import taxes on the value of the yarn (which include shipment charges), package them, market on social media, and deliver them to her clients (whether personally or delivery). On top of that, we both have to take care of our barely one-year-old daughter.

It’s not easy being a full-time parent while trying to run a business too. But we have to do what we have to do to raise our children. And reading up on news last week, I found this piece of economic news to be particularly alarming

U.S. Population Growth to Slow due to Trump’s Anti-Immigration Policies

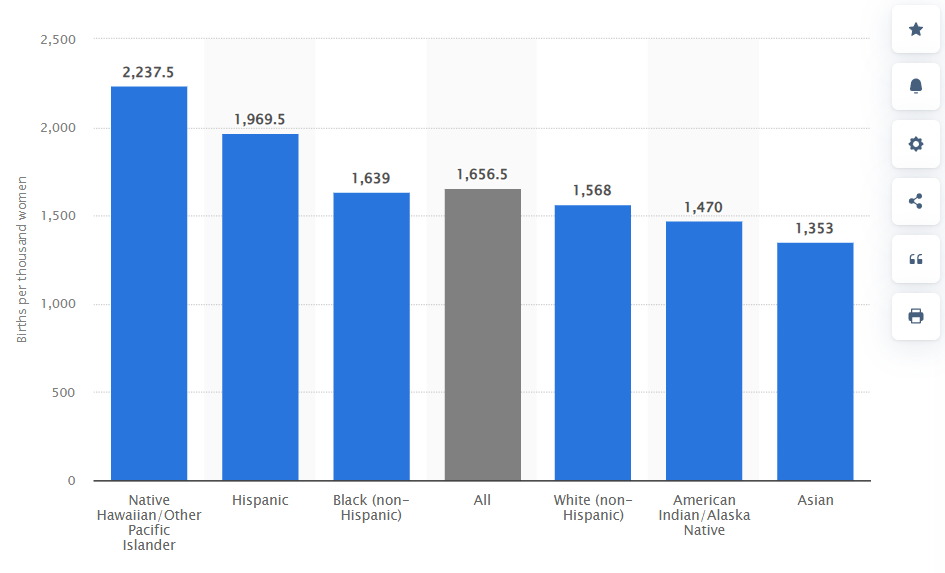

Here’s the interesting thing. Immigrants in the U.S. have more kids. Here’s the breakdown.

As many immigrants to the U.S. are from South America, we will use that as a proxy. Hispanic birth rates are about 18% higher than the overall birth rate for the average American. For many immigrants, they want to pursue the American dream that promises a roof over their heads, 3 warm meals a day, education and healthcare as long as they work hard for it. And immigrants do work hard for it. According to Economic Policy Institute, immigrants make up about 14% of the U.S. population but contribute a larger percentage of 18% to the U.S. economic output.

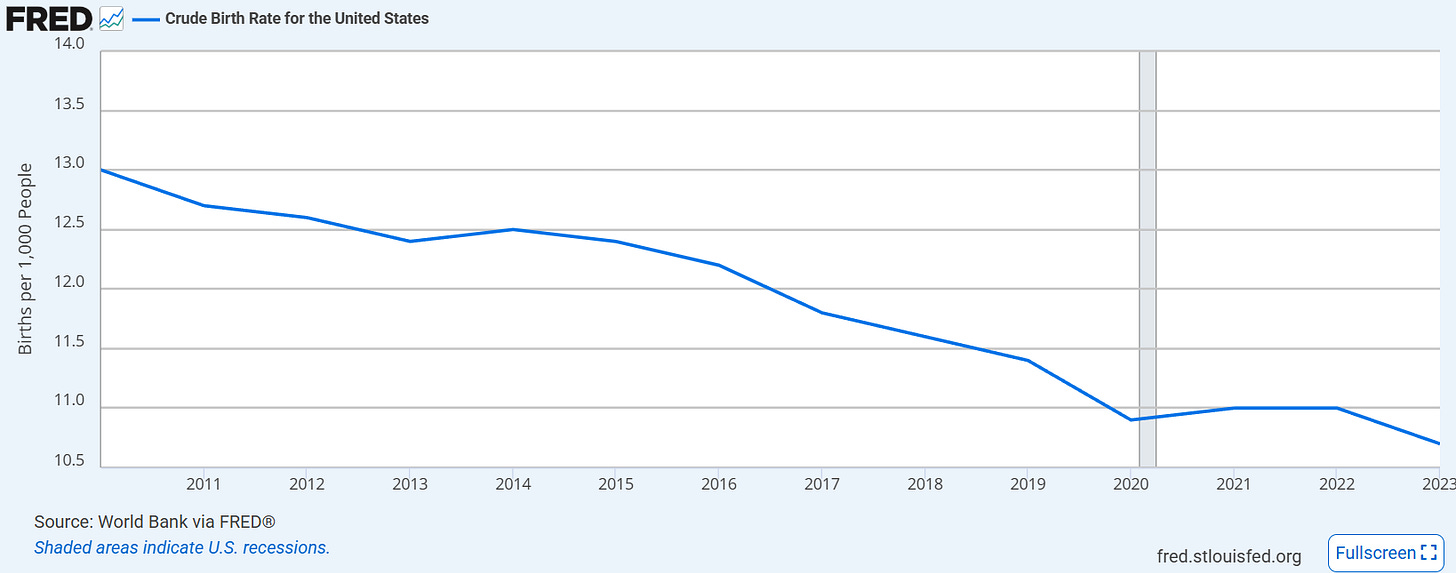

But Trump’s anti-immigration policy has changed that. The U.S. population is projected to grow from 349 million in 2025 to 357 million in 2035, 7 million less than its previous projection. It doesn’t help that Americans are having less kids as the cost of living increases for most. Birth rates per 1000 population fell from 13 in 2010 to 10.7 in 2023, according to data from FRED.

From an economic viewpoint, this is a disaster. Population growth is the most important factor for long-term growth, contrary to what AI tech billionaires think (they think machines should replace everyone, and make money for them without labour cost). People work, spend and invest in the economy. The more, the better. The more people there are, the more ideas they have. This increases the innovation and entrepreneurship in the economy.

Trump has preached this doctrine of promoting local industry growth, but this doesn’t cut if the population is not growing.

Speaking of Trump …

The U.S. Arrested Venezuelan President and Trump Wants to ‘Take’ Greenland

Trump described it like a Hollywood action movie. U.S. forces stormed the heavily fortified compound, had a shoot-out, managed to capture the Venezuelan President and wife, and extracted them to the U.S. to be tried. His face is full of glee as he watches this.

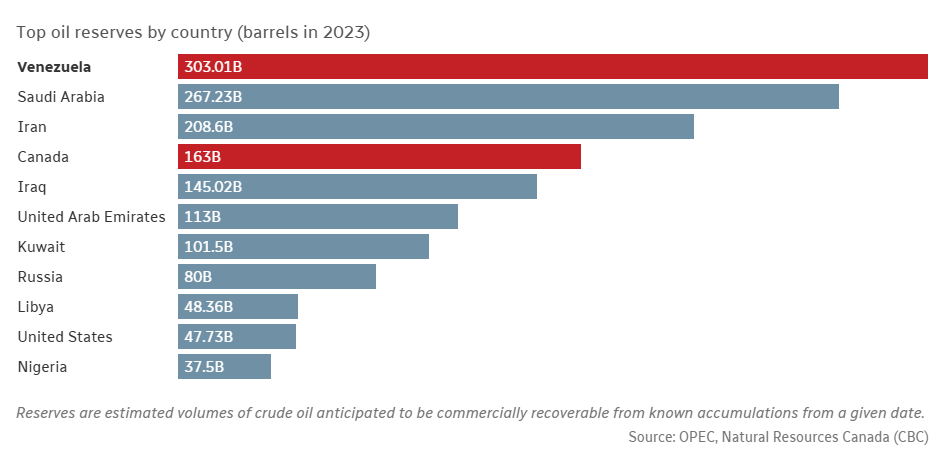

But we all know what the play is here. Even he admitted it. Venezuela has the world’s biggest oil reserves at 303 billion barrels as of 2023.

In recent years, many U.S. oil companies have pulled out of the country due to political instability in the country. With the arrest of the President, Trump now wants to ‘keep the oil flowing’ and get U.S. companies back into the country. A clear case of Bush-like U.S. imperialism to introduce ‘democracy’, but the real objective is to exploit natural resources in a foreign country.

The news sent oil prices downwards as traders and markets see this as a move to increase supply of oil in the global market. However, this will probably take time as these oil reserves need significant long-term investments to extract. So far, U.S. oil executives are not convinced yet of Trump’s plans to open the Venezuela oil fields for investments. Exxon Mobil cited that the Venezuelan government had seized their oil assets twice, and other oil executives had the same concerns, too.

Trump responded by kicking Exxon out and he said that oil companies will be dealing with him, and not the Venezuelan government. Reading more about this just sounds like an attempt to take control of another country to exploit its resources, like what colonialism did before this.

After that ego trip, he wants to ‘take’ Greenland too. This is not new, as he has talked about this in 2019. What’s new now is that he is also considering taking it by force or buying it outright from Denmark. This is a shift back to imperialism and colonialism to seize another country’s natural resources. Greenland has critical stores of rare earth minerals buried under the ice.

Trump is increasingly worried about the U.S.’ dependence on rare earth minerals, especially from China. According to data from the U.S. Geological Department, China produces 70% of the world’s rare earths. And China has used that as a trade bargaining chip in the previous round of trade talks.

By hook or by crook, Trump wants those natural resources. And if it involves going to war, the U.S. has shown in the past, it has no hesitancy in doing so.

Of course, this news had an impact on oil markets last week.

How did it Affect Oil Markets?

The WTI crude oil prices declined by 2.5% to $55.9 per barrel on 7 January 2026 from $57.3 on 2 January 2026 as investors priced in a possible increase in oil supply in the market. However, as news from oil executives began to flow, it was obvious that the incoming supply would be quite far off. Trump has been on an aggressive campaign to get them on board in Venezuela.

However, they remain unconvinced. Venezuela has, in the past, confiscated and seized assets from oil companies. The problem for oil companies is not the prospect, but whether the government will seize their assets again. When investors process this information, they project that supply will not increase in the short-run and hence, oil prices ended up 2.8% higher at US$58.9 per barrel at the end of the week.

This actually made me curious then, what are the prospects for the oil & gas sector heading into 2026?

Outlook for the O&G Sector in 2026

2025 was a weak year for oil markets. Oil prices declined by 20% for the year as the market was in a supply glut. Meanwhile, demand has weakened from the major economies in the world.

From the supply standpoint, OPEC has been increasing or maintaining its oil supply as it deals with low prices to keep the money flowing into its coffers. Meanwhile, global growth is projected to slow from 2.8% in 2024 to 2.3% in 2025, according to data from the World Bank.

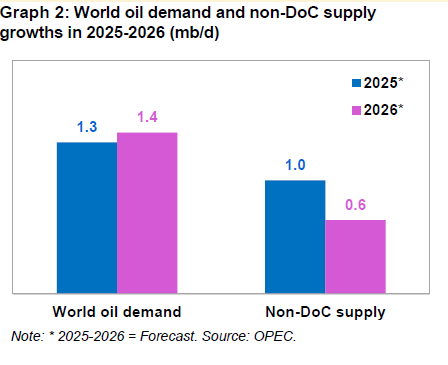

The outlook for 2026 is a bit more optimistic. OPEC, in its December 2025 report, projects that the supply of oil will decrease to support oil prices.

Growth-wise, the World Bank projects that global growth will increase slightly to 2.4% in 2026 from 2.3% in 2025.

If you have read all the way to the end, you are a champ. Thank you so much for reading my content and if you like it, give the channel a subscribe.

Appreciate all the support.