“She pooped!”

If this were 16 months ago, I would be panicking, rushing downstairs, and grabbing a fresh new diaper. Parenthood is tough like that when you also take care of a baby while working full-time remotely.

But I am used to it now. My wife, grabbing her by her armpits, was careful not to squish her poop (now in very solid forms). I took her and proceeded to wash her butt with water and soap (yes, yes, I know, most will use wet wipes but water is just so much more efficient).

“It stinks, just like yours!”, said my wife.

“Birds of a feather flock together … “, I said. My wife was not impressed.

“Poops of a clutter clump together”, I said confidently. My wife rolled her eyes and brought her away.

I am proud of that as a dad. We have become so accustomed to the routine and each other that we don’t even bat an eye (well, she does when she hears an awful dad joke).

And maybe that’s why I have also become very accustomed to Trump’s ‘tweets’ and ‘policies’ since his inauguration in 2024. Recently he has …

Proposed a 10% Cap on Credit Card Interest Rates

That’s right. Remember those pesky 18% credit card charges when you miss your payment? Trump wants to cap it at 10%. This is not new, as Bernie Sanders and Josh Hawley proposed the bill last year. That has stalled, as the financial lobby heavily opposes it (for obvious reasons). Here are the rationales of the move, which has got support from the Democrats (of course, this is the case, since Bernie Sanders proposed it last year) and divided the Republicans.

Trump has set a deadline of January 20 to cap interest rates on credit cards (which is tomorrow) and will likely use executive action to do so. Before we dive right in, let’s take a moment to understand the basics of credit card interest rates. You use a credit card to pay for things, and they are usually issued by financial institutions/banks. But you don’t fork out the money in the beginning. The credit card company ‘loans’ you the money to buy. By the end of the month, you will then repay the company.

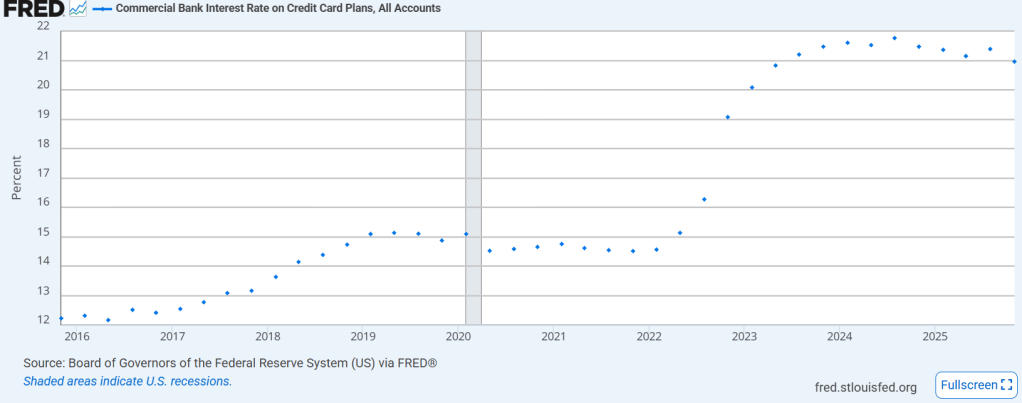

But if you don’t, the company imposes late charges or interest rates on the debt that you owe to them, and that typically is in the range of 15% to 30%, depending on your credit score. According to FRED, that interest rate has risen to 21% currently from 12% in 2016.

There are a couple of reasons why credit card interest rates have increased. But I will summarise it like this.

- The Federal Reserve has increased interest rates since 2022.

- Credit card companies face higher non-payments.

- They are also getting greedy.

Credit card interest rates, like many interest rates in other products, are dependent on the Fed’s interest rate policy. When the Fed increases the Fed Funds Rate, all interest rates also increase and vice versa. Since 2022, the Fed has consistently increased interest rates to fight rising inflation.

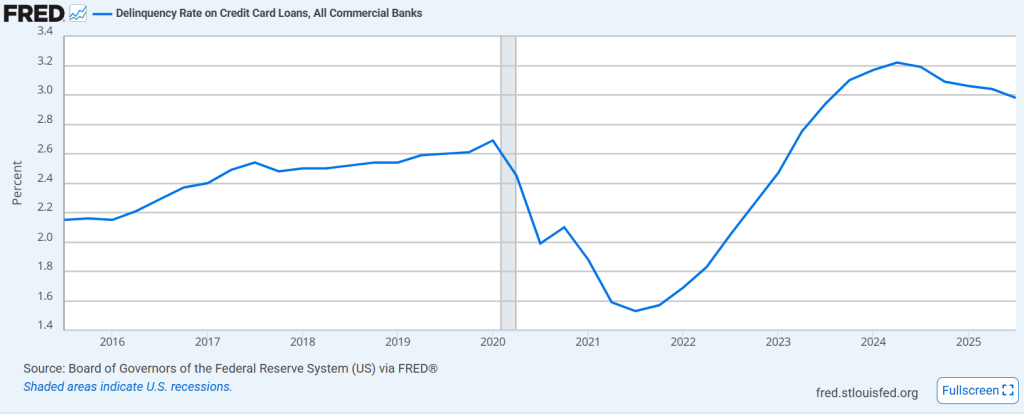

Rising interest rates aren’t good for people who can’t pay their credit cards on time. For one, they face higher fees and charges when they can’t even afford the repayment in the first place. As more people can’t repay, the delinquency rates increased, which it did. It doubled from as low as 1.5% in 2021 to 3.0% in 2025.

But that’s not the full story. Credit card interest rates are a major way for credit card companies to make money. If you can make 20% profit on debt, why won’t you issue more of it to people who don’t pay? And I think that’s what happened to them. To me, this is a way to prey on the low-income households in America, where they are less likely to pay. And when they can’t, their credit score gets worse, and their interest rates increase again. It is a vicious cycle.

I can foresee several impacts of this move on U.S. consumers and financial companies.

- U.S. consumers, especially lower-income households, could have their credit card charges reduced. This might alleviate some of their burden. However, I don’t think U.S. consumers will spend more just because their credit card charges are lower. If anything …

- They might face higher credit card application rejections. Credit companies will be stricter in their requirements and only service clients who are more ‘credit-worthy’ aka high-income households. This might end up hurting U.S. consumers if they need to use credit card to make ends meet (living paycheck to paycheck).

- Financial companies could face declining profits for the year, but ultimately, they will be fine. They already have quite a healthy profit margins from their credit card business before this, and have other finance segments to cover for it.

Speaking of financial companies …

Earnings for U.S. Financial Stocks are Out

Last week was a barrage of earnings results for the U.S. financial sector. And every financial executive has basically bashed the move by Trump to cap credit card interest rates. Those reactions are predictable. In my opinion, the bigger the company, the more likely they are to cry wolf. It is probably the case that this will not affect their bottom line by much. So, I took a look at the earnings results for these 4 big banks.

Goldman Sachs: 4Q 2025 revenue was down by 3%, but profits were up by 12%. Goldman’s quarter ended on a mixed note as it sold its Apple Card portfolio to JP Morgan, which affected its Platform Solutions segment. In 2024, Goldman made about $2.1 billion in revenue from its credit card portfolio here, but ultimately sustained a total loss of $7 billion since its collaboration with Apple in 2020. The key to this problem was that the Apple Card mainly served customers who couldn’t repay, and in 2024, it was served with a $84 million fine for failure to serve customers’ complaints. Goldman’s timing in disposing of its credit card business coincided with Trump’s move to cap interest rates. If anything, this move is viewed as positive for Goldman as its other business units are showing strong growth.

- Global Banking & Markets: +22% revenue growth, driven by higher investment banking activities as the quarter saw more mergers & acquisition activities.

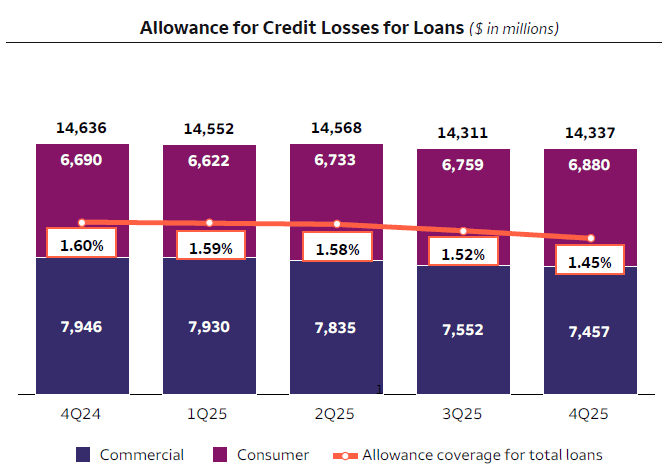

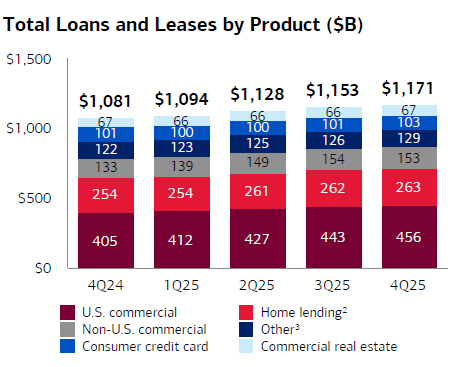

JP Morgan: JP Morgan’s 4Q 2025 results are the other way around. Revenue is up by 7%, but profits are down by 7%. Revenue was driven mostly by higher loans issued (+9%), especially in the investment banking division, where both revenue and profits grew by 10%. Its asset and wealth management division also recorded strong growth in revenue (+13%) and profits (+19%), driven by higher management fees and inflows. It recorded lower profits as it recognised losses from its Apple Card portfolio that it bought from Goldman Sachs. It has established a $2.2 billion in reserves for the portfolio. However, that is not the core issue for JP Morgan.

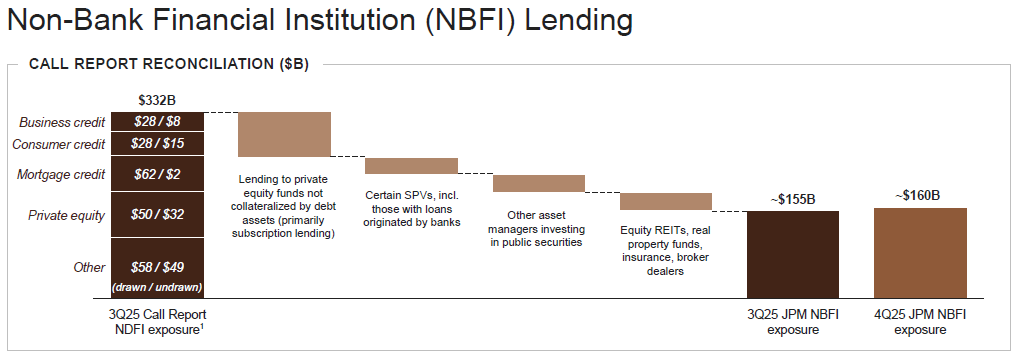

If you remember back in 2025, there was a significant issue in the private debt market. Jamie Dimon, the CEO, himself described the situation as ‘more cockroaches will emerge’. JP Morgan itself has taken a significant interest in private debt markets back in 2024, allocating $50 billion for its private clients. It had exposure to Tri-Colour when it collapsed after the First Brands auto supplier debacle. So, in this earnings release, JP Morgan had detailed its non-bank exposure to investors to inform them about its private debt markets.

I would look more into this, as JP Morgan has stated that it views private debt markets as a significant growth market in the past. It has now added a new advisory group to help companies tap into the private debt market. I would definitely say this is a risk factor to watch out for.

Wells Fargo: At least Wells Fargo has growth for its revenue (+4%) and profits (+5.5%). The Buffett-backed company’s higher performance was driven by two segments – Consumer banking (+7%) and Wealth Management (+10%). Yes, the credit card portfolio was up by 7% as it charged higher fees. Based on this, I can see that the company will be hit by the Trump cap on credit card interest rates. But it’s likely going to be small. Credit card revenue makes up only about 7.5% of its total revenue for 4Q 2025. Credit quality for the company remained unchanged as its allowance for credit loss was basically flat.

Bank of America: 4Q 2025 revenue and profits were both up by 7% and 12%, respectively, driven by its global wealth & investment (+10%) and global markets (+10%). The consumer credit card division makes up about 8.8%, quite similar to other banks. Hence, the exposure is there but not that big. Trump’s credit card cap could incur some losses but it will probably be manageable.

The Takeaway this Week

Financial stocks have been the talk of the town due to Trump’s proposed cap on credit card interest rates. While it could affect profits from the banks, I don’t think it’s going to be that big. At the end of the day, many U.S. consumers will still use credit cards and if anything, more might want to use them now. The worry is that with lower rates now, banks might actually issue less credit to consumers.

While I think it might be alright to choose banks with a lower credit card portfolio exposure, I don’t think it warrants a total overhaul of our understanding of banks now. If anything, I think it might be good for the U.S. economy as a whole, and slightly negative for banks with high credit card exposure.

If you have read all the way to the end, you are a champ. Thank you so much for reading my content and if you like it, give the channel a subscribe.

Appreciate all the support.