Be still, be calm,

The birds, fly above,

Rod in, reel out,

The fishes, jump about,

Bluish sky, clear water,

A lousy cast, here and there,

But a perfect morning.

There’s something philosophical about fishing. The act of waking up early in the morning, giving a kiss to my baby daughter and wife, and loading up the gear into the car. Admittedly, I am a beginner, and I just started fishing last week. It was a small pond beside a main road.

I tied all the knots at home, so all I did was bring out the fishing gear. The preparation was long as I watched countless videos on knots, gears and lures/baits. But once I started my first cast, it was … calming – almost spiritual in a way. Like that feeling when I am praying earnestly to God for strength and gratitude.

Cast after cast. I didn’t catch anything but algae and sticks. But I didn’t stop. Every cast felt like weights being thrown away. The process was addictive. Spotting ripples on the water, trying to throw it at the right spot, reeling it in after missing, and doing it all over again.

But what was so calming and relaxing was the sounds and sights of the morning birds. I can’t for the life of me name the birds, but there were so many different ones. Some forage by the small shores at the side. Some fly past above the electric wires. I understand now why nature heals. It certainly did for me.

This week’s newsletter is a bit different. If you have been reading it for a while, you will know that it’s very jam-packed with investments and finance. But I want to change things up. I realised that just talking about them makes me burn out.

Writing should be fun. And I am trying to explore the most fun way to do it.

If you are interested in my writing services, send me an email. I research all topics of investment and economics thoroughly, and will write pieces that inform and guide people’s decisions.

Trump’s On-and-Off Tariff on Europe

It’s a classic TACO (Trump Always Chickens Out) move by Trump. He first threatened 25% tariffs on Europe, then chickened out after reaching some sort of trade framework a couple of days later. Every time Trump pulls one of these moves, the objective is to distract you from his real goals and objectives. Based on what I have read, the market consensus is that he has two goals here – obtain access to rare earth mineral resources and prevent Russia and China from establishing any kind of foothold in Greenland.

I have talked about the first one before in last week’s newsletter here. The second angle on geopolitics is interesting. Putin has come out to literally say that he has no interest in Greenland, but this might actually weaken NATO, Europe’s military organisation/alliance. However, I did find the China angle a bit more interesting here. Traditionally, China’s ships take about 20 days to navigate and travel through the Malacca Straits to reach Europe. However, with global warming/climate change now, the summer is thinning the ice in the Arctic sea more every year.

The Arctic sea route takes about 10 days only, and last year, 14 Chinese ships made the journey. While it might take decades for that route to be commercially viable, China is always in the long game. It has the capability to do so, unlike American presidents.

However, at the current juncture, Trump’s strategy of doing this seems more weighted towards rare earth minerals. The United States is very reliant on China for rare earth that is heavily used in electric vehicles and almost all the electronic and electrical components in the world.

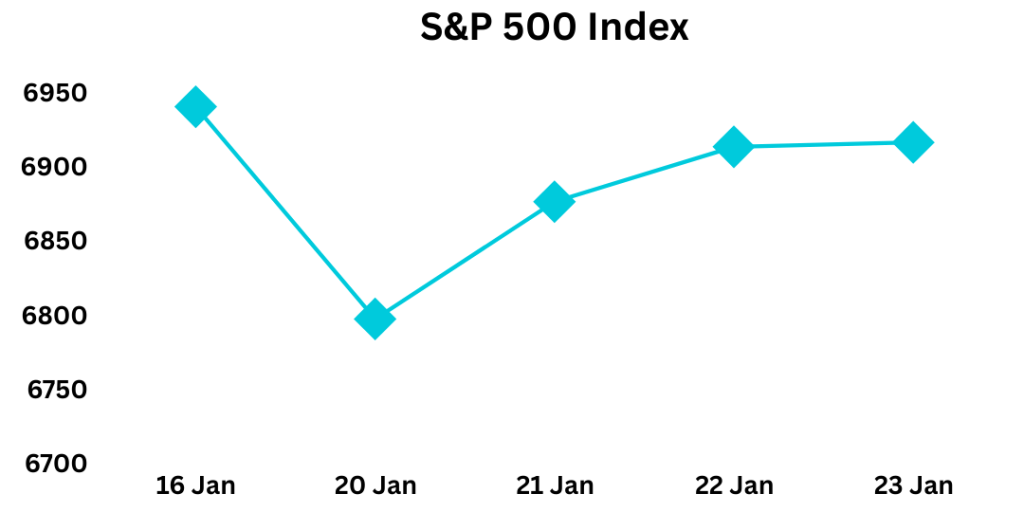

His tariffs have caused volatile movements last week. But markets were quick to pick on his TACO move, and subsequently recovered in the mid-week.

Takeaway: Generally, investors are getting used to Trump’s tactics and are able to tell whether the threat is genuine or TACO. Most likely it is TACO.

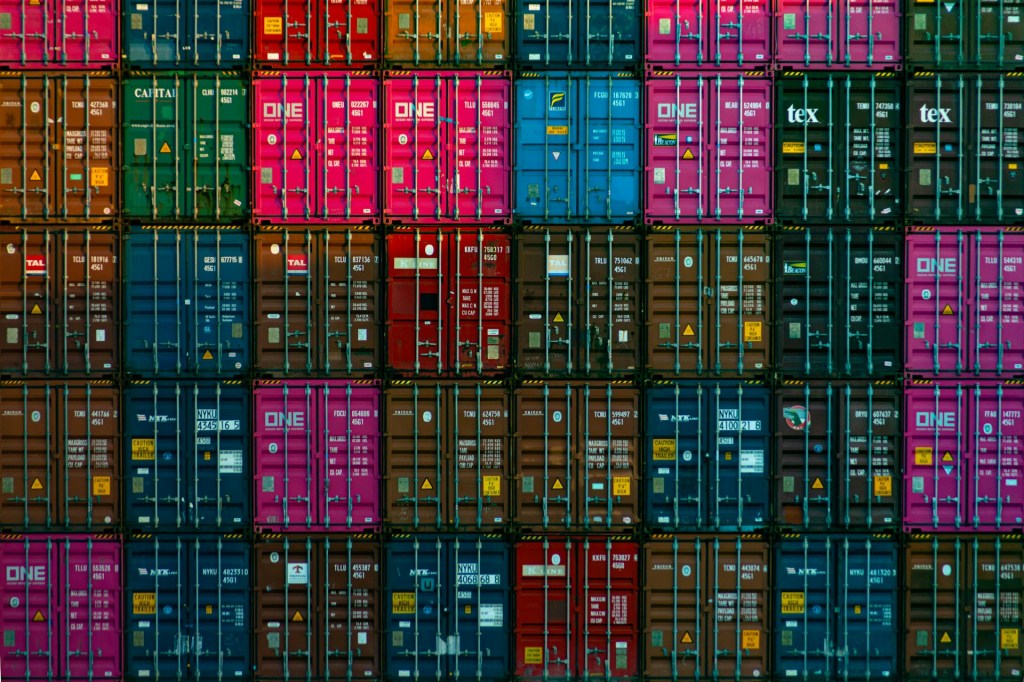

Speaking about tariffs ….

Americans Foot Most of the Tariffs

Well, it’s not a surprise really. I still remember the time last year or the year before, 2024, when I said that import tariffs are paid by the importers (United States) mostly. Yes, some suppliers do chip in for some of them, but typically they don’t have the obligation to do so.

Well, this article here written by the Wall Street Journal, shows these findings from the Kiel Institute for the World Economy

- American consumers and importers absorbed 96% of the tariffs.

- Foreign exporters absorbed 4%.

- Almost US$200 billion in additional U.S. tariff revenue was paid by Americans

- 20% of the tariffs increase were borne by U.S. consumers, with U.S. importers taking up 80%.

Reading this got me thinking. This partially explains why inflation in the United States hasn’t risen that much in 2025. By right, import tariffs increase consumer prices, as importers have to raise prices to protect their profit margins. So, this begs the question – did American companies’ profit margins decrease in 2025?

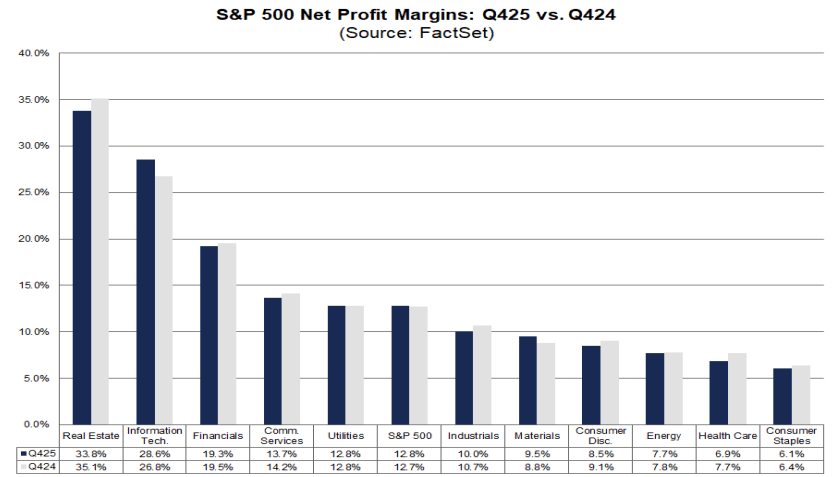

Here is the data from Factset. Blue bar is 4Q 2025, and gray bar is 4Q 2024.

The difference is too minute. To me, there wasn’t really any difference in profit margins between 2024 and 2025. You can make the argument that the consumer discretionary (2025:8.5%; 2024: 9.1%) and staples (2025: 6.1%; 2024: 6.4%) sectors saw declines in profit margins, but they seem to be quite small.

But maybe the tariff impacts are small, as Trump has certainly reduced the tariff rates in TACO style. According to Wharton, the average effective tariff rate was 10.6% in September 2025, an increase from 2.2% in January 2025. This is much lower than the headline number of 27.4%.

More interestingly, tariffs might have an opposite impact on inflation – it reduces inflation. The San Francisco Federal Reserve did a study, all the way back from 1897 to 2017, to look at tariffs. And the result? Tariffs cause consumers to spend less and lead to less demand. Lesser demand reduces prices.

Surprise? I was surprised. This was backed by cold, hard data, and a very long-term series, too. It is true, then, tariffs hurt Americans. But just in ways that are different.

Takeaway: Tariffs are paid mostly by U.S. consumers and businesses, but hurt the economy more by discouraging people from spending. This, in turn, reduces demand and inflation.

But American tariffs did not get in the way of this other economic superpower …

China’s Economy Grew by 5% and Sets 4.5% to 5.0% Growth Target

The Middle Kingdom hit its KPI for 2025. Gross Domestic Product (GDP) growth was at 5.0% for 2025, the same as it was in 2024. You know what’s interesting? Most of its growth was driven by exports, and not the domestic economy. This narrative is curious. We have all heard about the trade tariffs being imposed by Trump and how its was going to implode the Chinese economy.

But none of that has happened. Exports were up by 5.5%, with the trade surplus growing to its biggest yet of US$1.2 trillion. Of course, exports to the U.S. are down by 20%, but China was successful in driving growth to other regions.

- Southeast Asia: +13.4%

- Australia: +7.9%

- India: +12.8%

- Africa: +25.8%

Yes, the United States remains one of China’s key markets, but not by much anymore. As it can pivot quickly to other countries, it managed to produce the 5% growth to keep China’s industry humming. However, the domestic economy paints a completely different story. And that is more worrying.

Retail sales only grew by 3.7% for 2025, making this one of the lowest years yet for the Chinese economy. While it has not traditionally relied on domestic consumption for growth, the Chinese government had made it a point to pivot the economy towards the domestic market. After all, it has 1.4 billion people to tap into.

That’s why China is likely to set a range of 4.5% to 5.0% for 2026, as it views the current domestic market as weak, and exports are unlikely to lift the economy again for the year. What does this mean for the Chinese stock market?

Takeaway: Expect many of the domestic-oriented companies (especially property and real estate) to be uninteresting in 2026. There will still be some growth, but is probably limited.

However, the AI boom story in China is still going very strong …

Alibaba and Baidu Are Planning to List Their AI Chip Segments

Many of the Chinese AI IPOs last year have been so promising that Chinese companies are rushing to list now in 2026 again. This week, both Alibaba and Baidu are planning to do that for their AI Chip segments.

- T-Head, Alibaba’s chip unit is preparing to list

- Kunlunxin, Baidu’s chip unit has also did the same.

The race for Chinese homegrown AI chips is about to get bloody. But investors are dipping their toes, feet, legs, and whole bodies into this boom regardless. This boom reminds me of 2022, when everyone plunged into AI stocks en masse. But the reason for the boom is vastly different, even though it seems very similar.

In China, things work very differently. It is not as simple as there is a demand, so there is a supply. Most of these AI chip companies do certainly want to make a lot of money. But they all have to be under the ‘purview’ of Big Brother, the Chinese Communist Party (CCP). The reason why they are doing so well right now, is due to the government support they are being given – whether in funds, loans, technical expertise, and government preferential treatment.

China wants to match the United States in chipmaking capabilities. And the U.S. wants to slow their advancement in this field. However, Alibaba and Baidu’s involvement now spells a different ball game compared to the previous listings. Behind these AI chip units are deep pockets, with established businesses both in China and overseas, and possible synergies.

- Alibaba’s e-commerce and payment platforms could benefit from more AI technologies being powered by their own chips.

- Baidu’s search and advertising capabilities could increase manifold, too.

CCP might have found their national chip champions. And investors are all in knowing this.

It’s Always Better to Seek the True Truth

I know not which passage it was in Socrates’ books, but something really caught on to my mind since I am reading them now. It’s always better to seek the true truth of something, no matter what that something is, rather than stay where you are. For some reason, I always think of those words whenever I face challenges or things that I view as hard.

It gives me the strength to stand my ground and go through with it, knowing full well that I might fail spectacularly. True truth might be something near or far away. We never know. But we must pursue it regardless and stay true to ourselves. That’s how I see it. To question everything to its core of the true truth, to pursue it to the ends, means staying true to ourselves too.

Failing along the way is just part of it. I must never doubt and cower back to my bubble of ignorance, but continue going along the path to seek the truth for myself. For true truth might or might not reveal itself to you, but it will certainly light the path ahead.

Thank you for reading.

If you are interested in investment, economics, and philosophy/personal development content, subscribe to my page for more