Gold’s a fool’s low,

The glimmer deceives,

The shimmer releases,

A man’s greed,

For if there was no gold,

Silver comes, like bullets,

To a man desperate,

For quick riches.

Happy Tuesday? Well, I am writing this newsletter awfully late, as my baby daughter actively gets in my way of doing anything. But she’s so adorable, what can I do? Anyway, there’s lots of things happening, and if the cringy poem is a sign, you know what I am referring to.

Like what you are reading? Give us a follow and subscription for more content on investment, economics and personal development/philosophy.

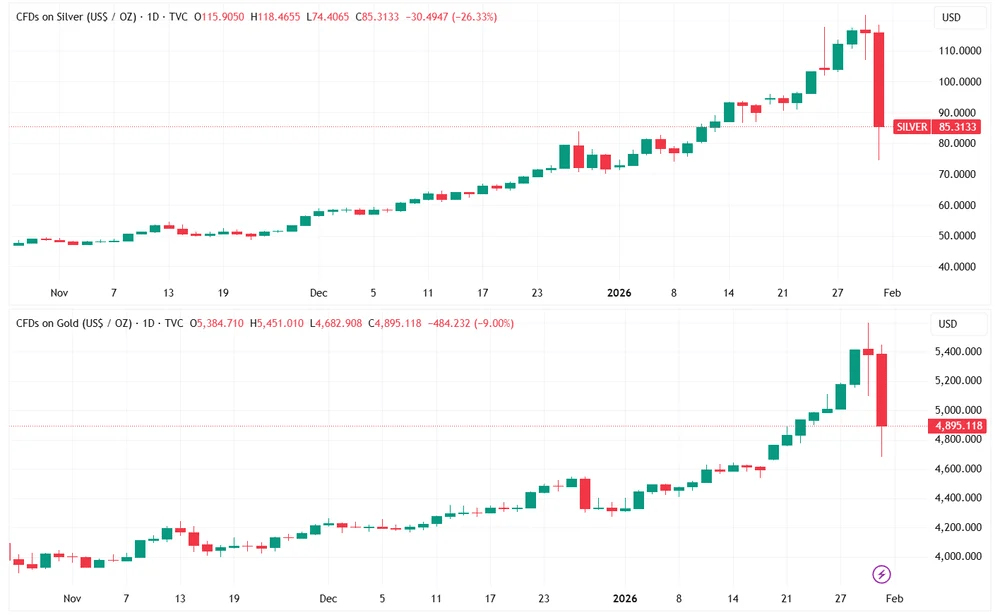

Gold and Silver Had Their Worst Performance Since 1980

It was brutal watching how the market for gold and silver fell last Friday. It was last Monday, when the news reported that gold prices reached a record-high of $5,000. Metal investors were popping champagnes when they got the news, convinced that the rally would continue and their bonuses and profits had not way of coming down. After all, they were convinced that the dollar was losing steam as investor confidence in the United States and its government bonds got thinner with Trump antics.

Things were going great still when Trump appointed Kevin Warsh as the Federal Reserve’s chairman. He’s known to be an inflation hawk previously, but many investors think that he will toe Trump’s line of low interest rates, which will make gold and silver more attractive to invest in. However, on that fateful Friday, things unravelled.

In just a day, gold and silver prices dropped by 30%. Investors who bought at the top, rushed to sell, further plunging the precious metals’ prices down. It was a classic panic setting in, as people realised that the markets were in bubble territory. It happened with pandemic stocks and crypto markets in 2020 and 2021, then moved on to the AI sector, then it has moved to the precious metals markets now.

Is the gold and silver market still worth investing in? That’s the biggest question investors have. Traditionally, gold and silver were considered official currencies before 1970. Paper money was backed by how much gold and silver the country had. It provided stability to countries and prevented them from spending too much money that they didn’t have. However, with the Vietnam war in the late 1960s, the United States had to print more money to fund the war, and hence, went off the gold standard. No more stockpiling gold to print more money, now you can just … print money.

And the whole world was dismayed by the United States. But they all eventually also got off gold and silver because they also want to spend. Because recessions require money. And when you don’t have enough gold, the citizens will be outside your office with pitchforks, demanding that the government do something.

So, there should be no more uses for gold and silver, right? Wrong. People still think of them as ‘currencies’ when they are not. Russia went on a gold standard because they have sanctions. But the rest of the world doesn’t. It’s considered a ‘safe-haven’ asset when things are going south (or north, if you are in the south), but acts more like an alternative asset class. When people lose confidence in the U.S. Dollar, they turn to gold and silver. But the thing is, most governments in the world hold U.S. government bonds as the safest asset.

So, how should we think about precious metals? The fundamental demand comes from people’s fear of what’s happening in the United States. So, they invest in gold and silver to ‘de-risk’ from the dollar. Other factors include demand for jewelry especially in India and China, where it is viewed as a status symbol and something to be desired. Furthermore, semiconductors and electrical components utilise silver and gold to make their parts.

Takeaway: Gold and silver are, in some ways, proxies of how much confidence people have in the U.S. Dollar. If it’s weak, they will turn to gold and silver. Watching for developments in the U.S. economy especially Trump policies will be key here.

Finally, the Federal Reserve will also have some influence on the gold and silver markets …

Trump Appoints Kevin Warsh as Federal Reserve Chairman

Well, if it’s not that Kevin, it has to be this Kevin. That’s how markets thought of Trump’s appointment of Kevin Warsh. Markets were happy initially, as they thought that he would continue the easy-money policy the Fed had over the years. But they quickly realise something was wrong when Warsh said he wants to shrink the Fed’s balance sheet but also cut interest rates faster. Everyone went like John Travolta here.

Does he know basic economics? These two statements are so contradictory. When you reduce interest rates, you are trying to buy more U.S. government bonds and hence, your balance sheet will expand. When you try to reduce your balance sheet, you are trying to sell more government bonds back to investors and reduce the money supply. This will reduce interest rates.

So, everyone is confused about what he wants to do. Maybe he’s trying to confuse Trump, but the rest of the world doesn’t think this really works. The other issue is whether the Federal Reserve will be independent, considering that Trump has been pressuring the Fed to reduce interest rates with lawsuits against Lisa Cook and Jerome Powell. They are still issues still being discussed at the Supreme Court.

Hence, investors are now watching keenly on how these lawsuits play out there. If the Supreme Court does indeed prosecute both officials on bogus charges, I think it’s safe to say there is no accountability anymore or checks and balances. Trump will become closer to a dictator – a thing that he likes.

This will have huge implications for the U.S. and global stock market.

Takeaway: Watch out for Supreme Court developments on Lisa Cook and Jerome Powell lawsuits. They will be the barometer on whether the U.S. government has any checks and balances.

Nvidia is Doubtful on its $100 billion Investment in OpenAI

Nothing like a healthy dose of scepticism. Remember that $100 billion investment by Nvidia into OpenAI last year? Well, that has gone nowhere. I think I know why Nvidia is sceptical now of OpenAI’s prospects. Firstly, OpenAI is still unprofitable. Don’t let the 233% revenue growth in 2025 ($20 billion) fool you. The company is burning cash at a rate of $17 billion a year.

Morningstar projects that it will burn more cash than Uber, Tesla, Amazon and Spotify combined. It will face a $207 billion cash shortfall by 2030 to fund its operations and investments. That is why OpenAI is desperate now for more funding.

- It has announced a new round of $100 billion in funding to raise from Nvidia, Amazon and Microsoft.

- It’s planning to list by the end of the year

The big question is whether these investments will generate the revenue and have the required returns. Investors are starting to doubt that, as competition has steadily eroded OpenAI’s market position. Last November, Alphabet released a game-changer, Gemini 3. It outperformed many of the LLM models out there, and OpenAI declared Code Red.

And halfway around the world, Chinese LLM models are making a huge push to dethrone American ones. What fun times we are at now. No wonder Nvidia is looking at the buffet of clients it has now.

Takeaway: It’s best now to monitor OpenAI’s success in attracting funding from the big tech companies, as it will determine how successful its listing will be by the end of the year.

Alibaba and Tencent Release New AI Models and Features

In China, things are going at a lightning pace. AI companies are springing up left to right, up and down, down in someone’s mother’s basement also. But the big boys are coming into the game, big. Alibaba and its AI company, Moonshot, have released new AI models to the market – Qwen and Kimi 2.5. Reportedly, they are able to compete with Gemini 3, ChatGPT and Claude AI.

Meanwhile, Tencent has also released an AI feature for its Yuanboa application, where users can join social groups with AIs to help facilitate discussion or do activities with. The AI competition in China is even more intense than the one in America. The Chinese government already has local initiatives to promote Chinese AI companies.

And their valuations have skyrocketed in China and Hong Kong listings. Everyone wants to get a slice of the pie. Alibaba is already readying its AI chip unit, T-Head, to list in the market sometime in the year. No doubt, its internal models will depend less on Nvidia’s AI chips.

Takeaway: AI models competition is heating up in China, and they are all rushing to list while investors are still hot for them.

Other News Headlines

Trump is threatening Canada with tariffs as the country wants to make a deal with China. [BBC]

Starbucks 4Q results were mixed, but at least its traffic grew for the first time in years. [CNBC]

Nvidia invests $2 billion into CoreWeave to expand data centre capacity [CNBC]

Meta 4Q results exceeded expectations as it seeks to spend more on AI [CNBC]

Microsoft’s 4Q results were mixed as investors expected stronger cloud growth [CNBC]

Zijin Mining is acquiring Allied Gold for $4 billion [SCMP]

Eastroc Beverage is listing in the Hong Kong market to raise $1.3 billion [SCMP]

Alibaba’s logistics arm, Cainiao will take a stake in robovan tech company, Zelostech [Reuters]

Muyuan Foods, China’s biggest pig company, is listing in Hong Kong to raise HK$10.7 billion [Reuters]

Thank you for reading.