In part 1, I covered the macroeconomics of the U.S. real estate sector and analysed that it is showing some signs of weakness as the U.S. job market softens. As the Federal Reserve is expected to reduce interest rates in 2026, the sector is expected to benefit from this. In part 2, I looked deeper into the real estate segments and determined that

- Data centre REITs and construction companies will probably be the best-performing sub-sector, driven by higher AI investments.

- Industrial REITs look like they are recovering from Trump tariffs.

- The housing market seems to be weakening but there are some opportunities in major cities.

- The retail space will be highly dependent on the strength of consumer spending, which in the current environment, shows a weak job market.

In the last part here, I will be identifying the specific REITs that I think are worth researching further. First, I will outline the steps I am taking to screen for the stocks, then provide some research into why I am taking a deeper look into them.

Screening for U.S. REITs

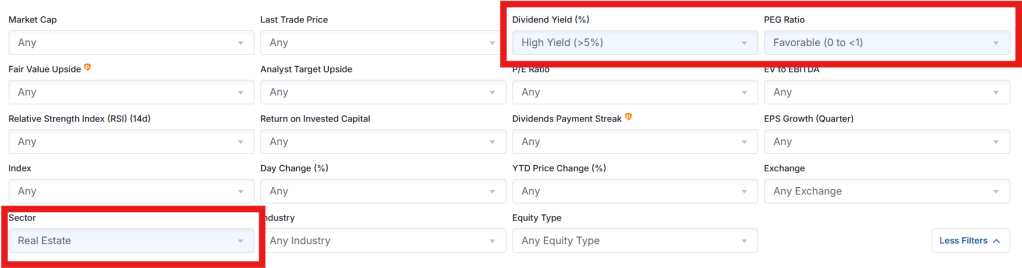

All the resources that I use to screen are free. I always tend to use the screener from investing.com here. And the criteria that I use are always consistent.

- Price-to-earnings-growth (PEG) ratio of 0 to 1. This indicates whether the stock is expensive/cheap to invest in depending on its projected earnings growth. 0 to 1 means that it is cheap.

- Dividend yield that is higher than 5%. REITs typically are obligated to give dividends, hence I am going for some of them that delivers high dividends.

Here’s how it looks like on the screener.

From here, I got a list of stocks that fit the criteria, and I sorted them by market capitalisation. I think that companies with a higher market cap/valuation have a stronger market position.

I went through the list one by one (going to the website to determine what kind of REITs they are, and whether they fit the criteria). Here are 4 of them.

1. Digital Realty Trust: A Data Centre REIT with Diversified Exposure

Digital Realty Trust (DRT) is a data centre REIT with over 300 data centres in 50 cities. It serves clients in the AI, network, cloud, digital media, mobile, financial services, healthcare and gaming. Notably, it has exposure to the big boys in the AI industry.

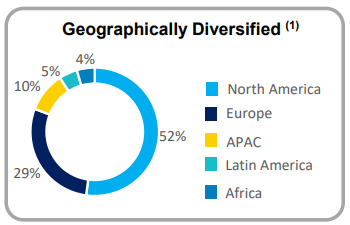

DRT has a wide geographical reach with 52% of its data centres in North America, followed by Europe (29%), Asia Pacific (10%) and Latin America (5%). It currently has about 2.8 gigawatt (GW) of capacity with 750 megawatts (MW) under construction. And in the future, it could build up to 5.0 GW of additional capacity based on its landbank now.

Looking at DRT, there are a couple of points that I want to talk about.

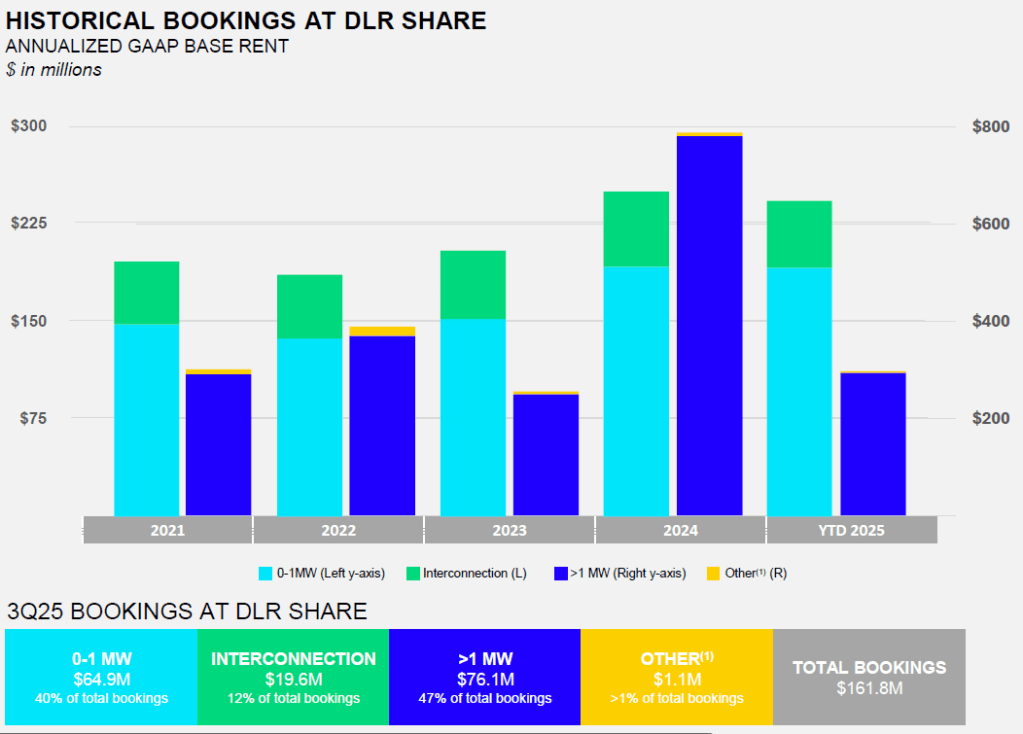

DRT relies a lot on new contracts and also renewal of contracts to sustain its financial growth. The volume matters, so does its pricing. In 3Q 2025, it secured about $202 million in bookings.

- 0 to 1 MW contracts made up about 40% of total bookings, while more than 1 MW bookings made up 47%. About 50% of these bookings are AI-related.

- However, more than 1 MW of bookings in 2025 seemed to be slowing from 2024. No doubt, the 2025 data does not have 4Q bookings yet, where companies typically renew by the end of the year.

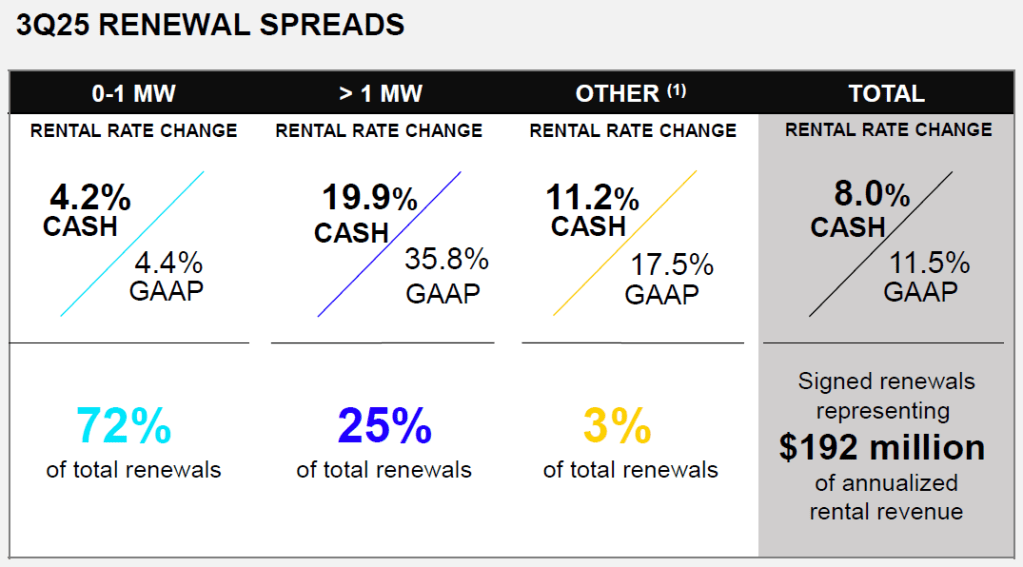

I interpret this as a small risk in the big scheme of things. But as I read further, I am comforted by the fact that its renewal rates are growing steadily. It has been able to record 11.5% increase in rental rates for 3Q 2025, driven mainly by more than 1 MW customers (+36%). Meanwhile, 0 to 1 MW renewals show only around a 4.4% increase.

I would like to see DRT focusing more on bigger contracts, and that’s why it has been investing heavily in large capacity blocks that could serve the big hyperscalers. Its large contiguous capacity blocks are projected to come online by the end of 2026 or early 2027, which coincides with many big clients’ period of renewal. At the end of the day, they are the ones who can splash the big bucks.

Financially, DRT’s revenue has grown by 9% every year from 2020 to 2024, and is projected to grow by the same rate for 2025 (9M 2025: +8.7%). Meanwhile, profits are volatile as it incurs one-off items and gains regularly. For 9M 2025, profits have tripled to $1.2 billion as it recognises gains on disposal of data centres.

Finally, valuation. The price-to-earnings ratio is at about 42 times, which is expensive if you compare it to the industry average of 28 times. However, its PEG ratio, which measures how cheap/expensive it is to purchase the stock based on its forecasted earnings growth, is only at 0.17, which is very cheap.

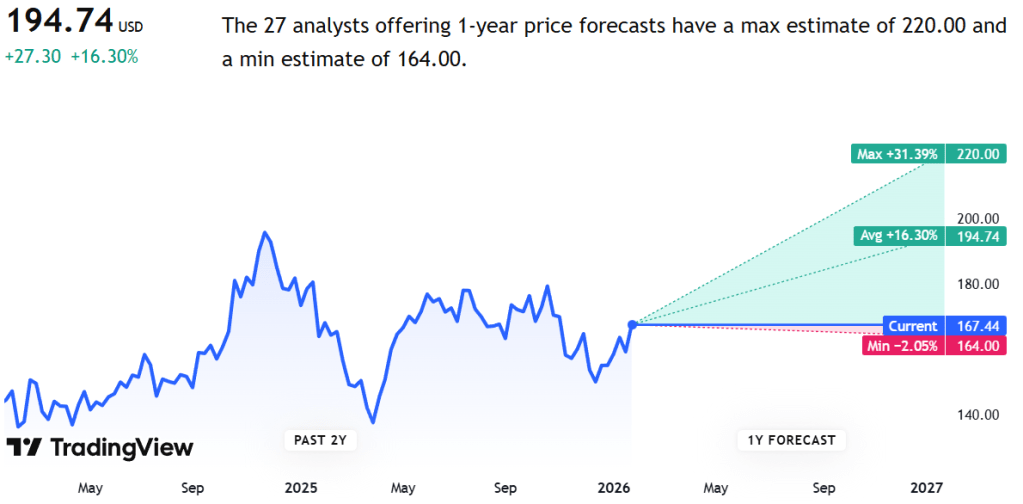

Trading View has the company at a target price of $195 with an implied upside of +16.3%.

2. American Tower: Another U.S. Data Centre REIT

American Tower owns and operates communication sites, leasing them to wireless service providers, broadcasters, and other clients. The company typically provide the land with a concrete tower and power, where its clients will bring in their own equipment. So, you can think of American Tower as a REIT that rents out sites to these players, and receives regular rental.

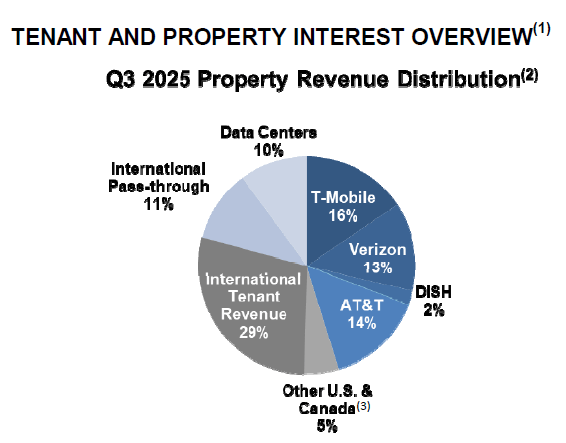

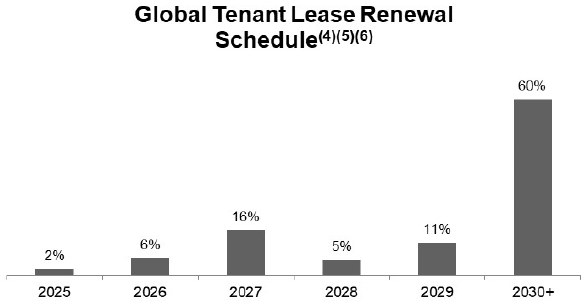

The Big 4 U.S. wireless provider, T-Mobile, Verizon, Dish and AT&T make up about 45% of its revenue. Meanwhile, its international clientele provides close to 30%. Lastly, data centre makes up about 10% of its revenue.

There are several pros and cons that I would like to talk about here. Let’s start with the pros. Firstly, it has a very solid core clientele in wireless service providers (T-Mobile, Verizon, Dish and AT&T) that has very long rental contracts with American Tower. Typically, these contracts run from 5 to 10 years, and renewal rates grow by about 3% annually to keep up with inflation. This is a stable revenue source, which doesn’t require a lot of monitoring as they are long-term. 60% of its clients are due for renewal past 2030.

Secondly, it has exposure to the data centre segment at about 10% of revenue. The company has cited that this segment will be its growth story, which complements the booming AI industry. Data centre revenue grew by 14% in 3Q 2025, higher than the overall growth of 7.7%. Furthermore, it has also been guided that 4Q 2025 growth will be around 13%. The company is spending about $600 million in its data centre segment for 2025, which represents about one-third of its capital expenditure.

Thirdly, it has had very stable growth in the past 5 years. Revenue grew at 6% every year from 2020 ($8.0 billion) to 2024 ($10.1 billion). In 2025, revenue is projected to be flat at $10.2 billion. While investors would like to see strong growth, I believe there’s value to stable and boring growth. It’s easier to predict, and you don’t have to spend so much time poring its financial results.

Its cons? Well, it seems to be not so plugged in to the AI sector. Don’t take it the wrong way, data centre segment growth is still fine, but there are other companies which have been able to pivot faster. It makes sense for a stable and boring company, but it could be sidelined and left behind if it doesn’t act fast. That’s why valuations have been relatively cheap at a 27.3 price-to-earnings ratio. We have seen DRT above garnered 42 times.

Furthermore, while data centre is the next growth story, margins have been relatively low for American Tower. Its core property gross profit margin is high at 70%. However, its data centre segment margin is at 53% as of 3Q 2025. No doubt, this margin is higher than 48% in 3Q 2024. But it shows that American Tower would need to figure out how to achieve higher margins in its core property segment to justify the increased investments in the future.

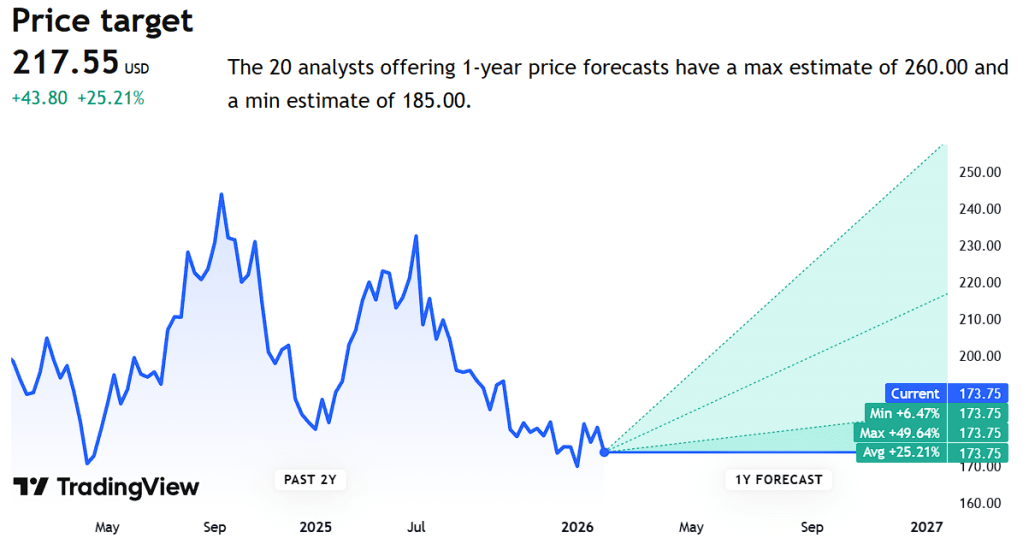

Trading View currently has American Tower at a target price of $217 with an implied upside of +25%.

3. Prologis: Biggest Industrial REIT

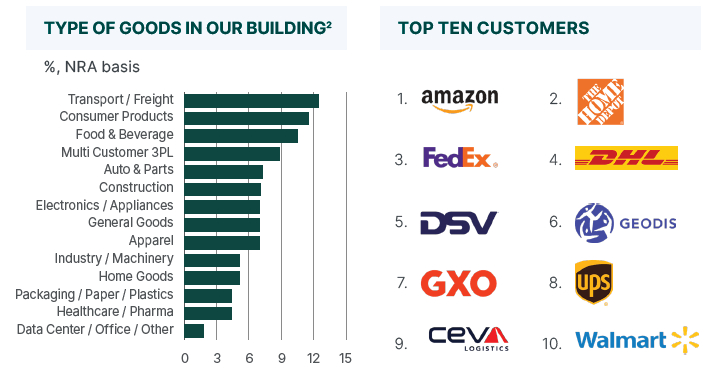

Prologis is a logistics real estate investment trust that has operations mainly in the United States (about 85% of operating income). It mainly serves customers in the transport & freight, consumer products, food & beverage, and auto parts sectors, with top clients such as Amazon, FedEx, and Walmart.

It’s not an exaggeration to say that this might be the biggest industrial REIT by far. It has a market capitalisation of $128 billion, with $230 billion in assets under management. Few things I want to highlight here.

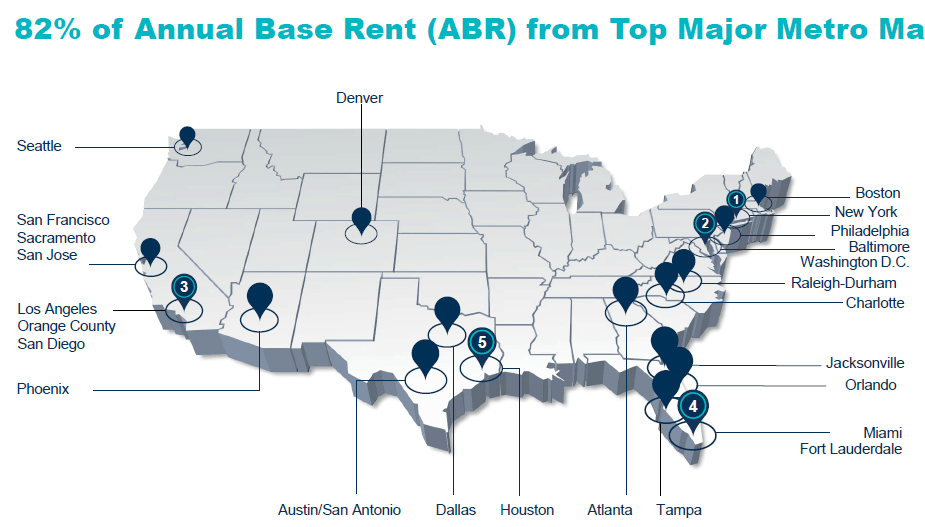

One, its exposure is wide … very wide in the United States, which makes it an ideal logistics REIT. 19% of its assets are situated in Southern California, which basically means Los Angeles. New York City is at 8.5%, followed by Chicago (5.6%), Florida (4.6%), San Francisco (4.4%) and Dallas (5.1%). These are the main cities in the United States that are the centre of trade with the rest of the world.

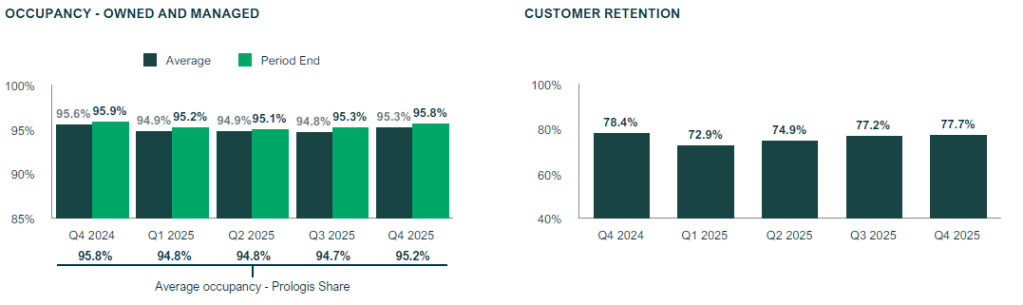

Two, occupancy rates have also been decent, averaging about 95% in the last 5 quarters. It has managed to retain about 80% of its customers. Both these figures show that Prologis has the market power to maintain high occupancy by retaining its clients.

Three, its financial performance has been very strong, which is not typical of a REIT. Revenue doubled from $4.8 billion in 2021 to $8.8 billion in 2025. Most of this growth was driven by very strong demand for transportation and logistics services during and after the pandemic. 2022 and 2023 saw average growth rates of 30%.

However, its profits leave something to be desired. It has not followed the trend of revenue. Instead, it only grew from $2.9 billion in 2021 to $3.3 billion in 2025, which means that its margins are declining (2021: 62%; 2025: 38%). I dug a little deeper, and realised that it’s not its operations that are leading to lower margins. After all, its operating profit margin has actually been stable at 38% over the five years.

It is actually interest payments that have soared, from $266 million to $1.0 billion. True enough, its total debt has also almost doubled from $18 billion to $33 billion. And from here, the company is taking on more risks and paying a higher interest on its debt. Well, I surmise that is also due to the fact that broader interest rates have increased from 2022 onwards.

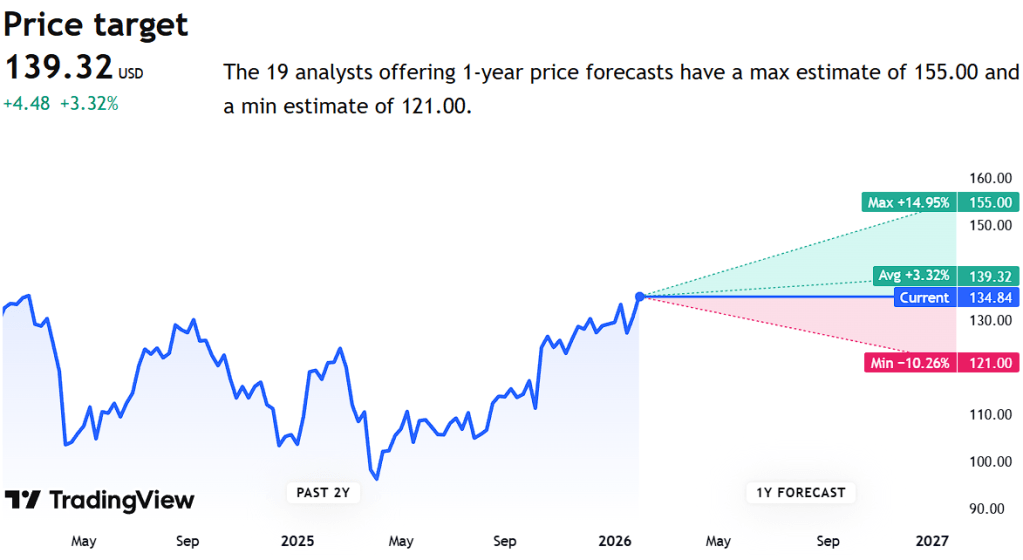

Trading View has Prologis with an average target price of $139 with an implied upside of +3.3%.

4. Kimco Realty: The Commercial REIT in Major Cities

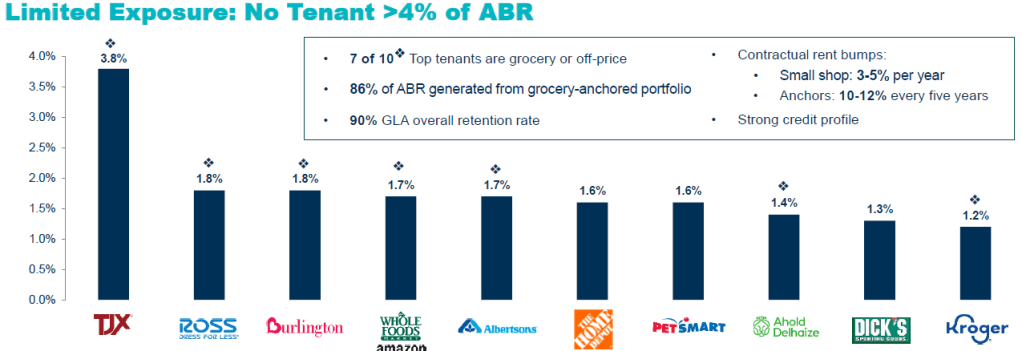

Kimco Realty is a REIT that owns and operates grocery-anchored shopping centres and properties in American suburbs. Kimco has a half-half mix between anchor and small shop tenants, where 86% of annual base rent is generated from anchor tenants. It operates around 560 properties situated in the sun-belt and coastal areas.

There is a specific reason Kimco made it to the list as a commercial REIT (despite the weak job market and current spending). It has a higher exposure to the higher-income households. It estimates that the population in a 3-mile radius from its properties earned a median salary of $101,000, 27% above the national average. This is actually riding the K-shaped economy trend now. If you don’t know what it is, it’s basically the state of the U.S. economy now, where, on average, it’s doing ok. But it’s mostly driven by higher-income households, while the other income groups are not doing too well.

I can see that many of Kimco’s clients caters to higher-income household such as

- TJX

- Burlington

- Whole Foods Amazon

- Trader Joes

- Sprouts Farmers Market

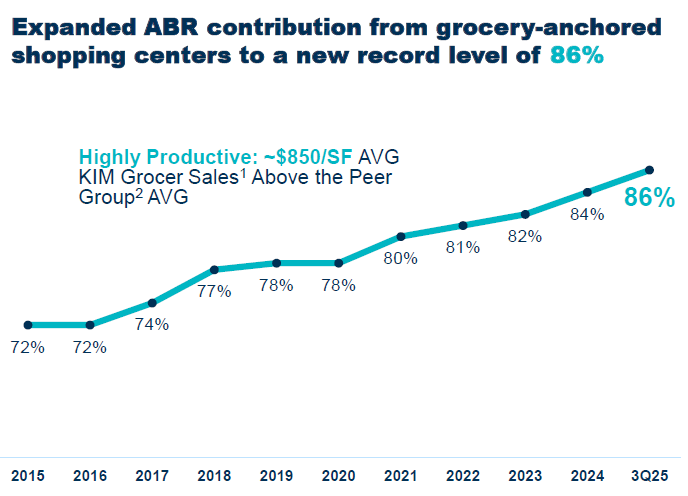

Its strategy is also simple. Attract more customers to its properties by having more grocery anchors that cater to higher-income households. In the past 10 years, grocery-anchored shopping centres contributed more to its annual base rents, growing from 72% in 2015 to 86% in 2025.

Financially, it has also done very well. Revenue doubled from $1.1 billion in 2020 to $2.1 billion in 2024. While growth has slowed in 2025 due to Trump tariffs’ impact on consumers, it is still projected to log about a 5% growth.

Its profits tell a different story. It shows that profits are declining. And I think I know why. The valuations on its properties could have gone up significantly during the pandemic (2020 and 2021), but crashed back down when the Fed increased interest rates. This is why sometimes, I don’t really like looking at REIT profits. It’s muddled by property valuations that changes with the interest rates.

So, I look at its operational cash flow. It has doubled from $589 million in 2020 to $1.0 billion in 2024, consistent with revenue. This paints a picture that the company is still doing alright.

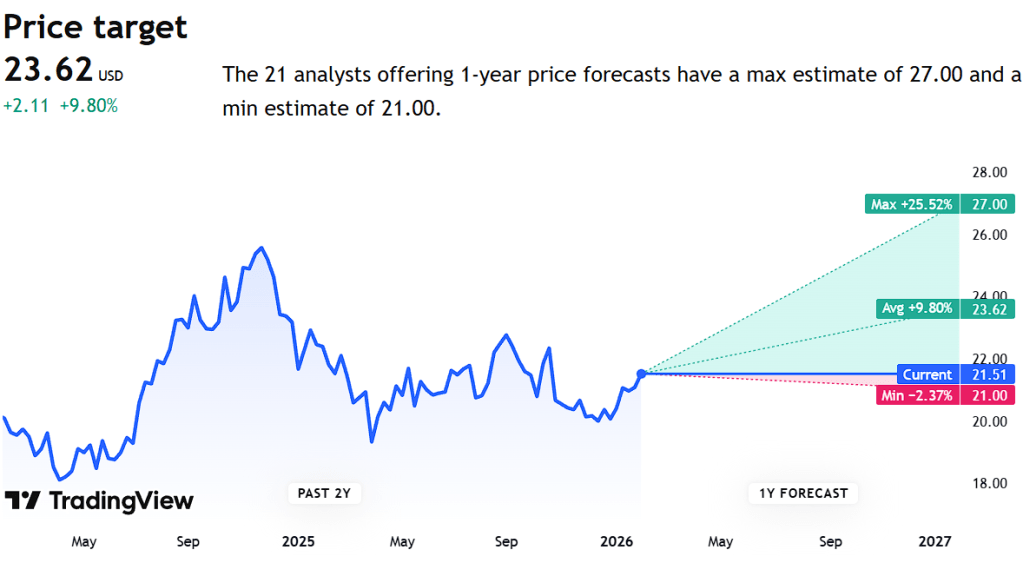

Trading View has the company at a target price of $23.62 with an implied upside of +9.8%.

Conclusion

I hope you have found this piece to be informational and useful. Disclaimer: This is not investment or financial advice, and I take no responsibility for anyone’s decisions.

The real estate and REIT sector in general could find itself benefiting from lower interest rates for the year. Some are projected to do well (data centre and industrial), and some are not (housing and commercial). Take a good look at the research I have done here.