I Review the U.S. Real Estate Sector – Part 3

In part 1, I covered the macroeconomics of the U.S. real estate sector and analysed that it is showing some signs of weakness as the U.S. job market softens. As the Federal Reserve is expected to reduce interest rates in 2026, the sector is expected to benefit from this. In part 2, I looked deeper…

Keep reading

All that Glitters Turn into Ash (Fresh Off the Oven Newsletter)

Gold’s a fool’s low,The glimmer deceives,The shimmer releases,A man’s greed, For if there was no gold,Silver comes, like bullets,To a man desperate,For quick riches. Happy Tuesday? Well, I am writing this newsletter awfully late, as my baby daughter actively gets in my way of doing anything. But she’s so adorable, what can I do? Anyway,…

Keep reading

Trump Threatens Tariffs on Europe (Fresh Off the Oven Newsletter)

Be still, be calm,The birds, fly above,Rod in, reel out,The fishes, jump about,Bluish sky, clear water,A lousy cast, here and there,But a perfect morning. There’s something philosophical about fishing. The act of waking up early in the morning, giving a kiss to my baby daughter and wife, and loading up the gear into the car.…

Keep reading

Trump to Cap Credit Card Charges (Fresh Off the Oven Newsletter)

“She pooped!” If this were 16 months ago, I would be panicking, rushing downstairs, and grabbing a fresh new diaper. Parenthood is tough like that when you also take care of a baby while working full-time remotely. But I am used to it now. My wife, grabbing her by her armpits, was careful not to…

Keep readingI Review the U.S. Real Estate Sector (December 2025) – Part 2

Could 2026 be the year for property? In the first part here, we examined the macroeconomics fundamental of the U.S. property sector and found that: In this article, we will take a deeper look at the U.S. property sector in 2025 and analyse which sub-sectors did well and are expected to do well in 2026.…

Keep reading

Welcoming 2026 with a Bang? or Whimper?

My Thoughts for the Week Welcome to 2026, where nothing much has changed, but we still have to talk about Trump. Fresh on people’s minds, will there still be tariffs? The U.S. Supreme Court has yet to decide on that, but expect a decision by end of January 2026. The U.S. job market is showing…

Keep reading

Bad News Means Higher Stock Markets

My Thoughts for the Week As the holiday season gets underway, investors are feeling a tad optimistic but also cashing out some of their riskier investments. The consensus is that the U.S. Federal Reserve will not let the stock market tank and will cut interest rates. I agree also, as I have seen the Fed…

Keep reading

Trump Called Jerome a ‘Numbskull’ (Fresh Off the Oven Newsletter)

It’s good to be back after a holiday. This week, I have a lot in store for you. Meme Comic to Send You Economics At Your Fingertips China Inflation Is China in a Japan-like Lost Decade? It certainly looks like so. Inflation for May 2025 is at -0.1%, the same as in April 2025. Deflation is China’s…

Keep readingFresh Off the Oven Newsletter – Wiped Out by Trump Recession?

It’s the mother of all days. Happy Mother’s Day! Well, it’s the time of the year when everything from roses to cards costs an arm and a leg. But then, many women are opting not to be mothers these days. Interestingly enough, one fellow from King’s College London is blaming phones for why women don’t…

Keep reading

What I Learned Investing and Making 11% Profit on Teo Seng Capital

Why did the chicken cross the road? Becaaauuuusseeee If you read that and laugh, well, I did too. Shame on us for being easy. You see, in January 2024, I came across an interesting investment prospect called Teo Seng Capital. The company distributes and sells chicken, eggs and chicken feed in Malaysia. TLDR: I decided…

Keep reading

Fresh Off the Oven – Merry Christmas

Christmas cheer is here, and so is Mariah Carey’s annoying song that won’t stop playing in my head. “All I want for Christmas is you” At this point, all I want is for that song to stop. But the show must go on. So is this newsletter. This week, we are changing things up a…

Keep reading

Fresh Off the Oven – Learning About Japan’s Property Investment Strategy

I did read some interesting this week. It was about how some big boys of finance were buying up all sorts of Japanese companies for their properties. Did I read that correctly? No, not their fundamentals, not their potential outlook for the future, but properties. More specifically, properties that they own from way back in…

Keep reading

Here are the 5 Malaysian Telecom Companies I am Looking At

I have previously written that the telecommunication sector is at a sweet spot of being undervalued and has a high forecasted earnings growth rate in Malaysia. Now, I am looking at the specific companies that fit this criteria. Here is the stock screener that I used from investing.com to screen for the companies in the telecom sector How I…

Keep reading

Fresh Off the Oven – Taking a Look at China

I am not going to lie. I used to cover China’s economy and stock market extensively in my old job as an economist. But I got sick of it. Not because I was not interested in doing the analysis. I loved being an economist and stock market analyst. But corporate just sucks, and that’s it.…

Keep reading

Fresh Off the Oven – Taking a Good Look at Malaysia’s Market

Source: Unsplash One thing caught my eye this week. And no, it’s not a pretty girl. I am a married man. One wife is enough. The FBMKLCI (Malaysia market) is still trading at only around 1,600 levels. And it has been so for the past few weeks. If you have been reading some of the…

Keep reading

How to Identify Winners from Budget 2025

Winner, winner, chicken dinner. Or as the industry said, pick winners. But I am not doing that. Many research houses did that for Malaysia Budget 2025 when I highlighted what they said here. Instead, I will outline the research process, theory and practical application of reliably identifying companies that could gain or lose from the…

Keep reading

5 US Companies that I am Looking at For Rate Cuts

Source: Unsplash Researching and writing about companies is a strange one. Many expect people to pick stocks for them. But I don’t believe in that. I believe that it’s easier and better to do your research on them. What I will do here is outline the research process I take to identify stocks that are…

Keep reading

Fresh Off the Oven (13 Sep – 20 Sep)

50, the magic number! The Federal Reserve pulled a 50 bps rate cut on everyone. And it has been glorious for markets and investors. This week, we are covering the impact of the 50 bps rate cut on the US, Chinese and Malaysian markets and taking a look at the economic news coming out. Are…

Keep reading

Cutting into the Crust Newsletter (13th September 2024)

If you are having problems identifying which companies to research and invest in, you have come to the right place. Cutting to the Crust newsletter is a comprehensive newsletter on the 4 to 5 companies from the U.S., China, Malaysia and other countries that have either performed mightily well from last week or are in the…

Keep reading

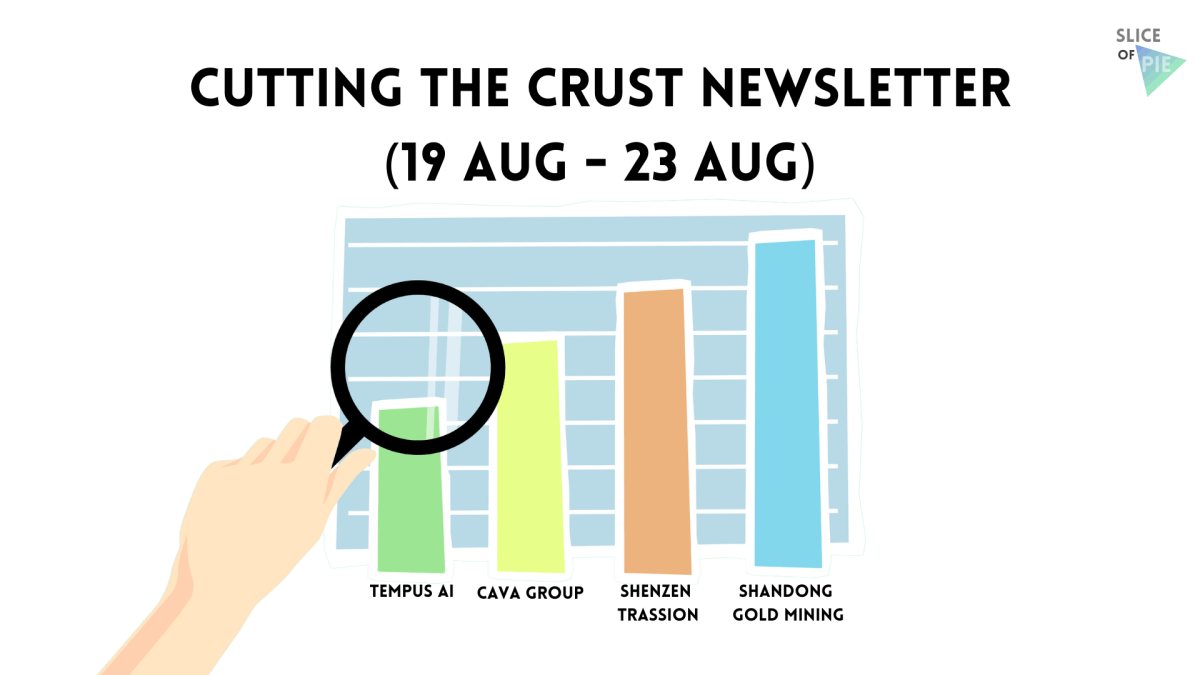

Cutting the Crust Newsletter (19 Aug – 23 Aug)

If you are having problems identifying which companies to research and invest in, you have come to the right place. Cutting to the Crust newsletter is a comprehensive newsletter on the 4 to 5 companies from the U.S., China, Malaysia and other countries that have performed mightily well from last week. Every week, we will…

Keep readingSomething went wrong. Please refresh the page and/or try again.